Housing affordability has become a focus after the Government reacted to the Productivity Commission's recommendations. Business editor Dene Mackenzie reports on the issue.

Property Investors Federation president Andrew King says housing is a complex issue that plays a critical role in people's lives whether they are home owners or renters.

It was difficult for the Government to make legislative changes aimed at changing the behaviour of people.

"It is usually doomed to failure as preconceived ideas get in the way of sound problem analysis and the implementation of well-researched solutions."

But that was what the Government was trying to do. Finance Minister Bill English agreed last week with the Productivity Commission that housing could be made more affordable. So the Government has started on a programme to make that happen.

Mr English warned there would be no quick fixes. Instead, work was needed in several complex areas and across multiple government, local government and private sector agencies to tackle issues that were deeply imbedded.

The Government had four main aims:

• Increasing land supply - that would include more green-fields and brown-fields developments and allowing further densification of cities, where appropriate.

• Reducing delays in and the costs of Resource Management Act processes associated with housing - that included introducing a six-month time limit on council processing of medium-sized consents.

• Improving the timely provision of infrastructure to support new housing - including considering new ways to co-ordinate and manage infrastructure subdivisions.

• Improving productivity in the construction sector - including an evaluation of the Productivity Partnership's progress in achieving a 20% increase in productivity by 2020.

"Decisions made by local councils not only affect their communities, but have wider effects on the economy and the Government's books.

"Many of the changes that will make a difference lie with councils and the Government expects them to share the commitment to improving housing affordability," Mr English said.

Labour Party finance spokesman David Parker said a capital gains tax was a key part of house affordability, something Mr King firmly disagreed with.

Mr Parker said the Government's refusal to consider a capital gains tax, that would help put a lid on property prices and increase wages, showed it was not serious about making housing affordable.

"Owning your own home is a dream that's disappearing for many hard-working New Zealanders, in part because the tax bias effectively subsidises landlords," he said.

Proponents of a capital gains tax on rental property believed it was the right thing to do because they believed property investors had been the cause of property price increases, Mr King said.

"They believe that property investors have a tax advantage over first-home buyers and therefore have an advantage when bidding for property. This is clearly incorrect."

More often than not, property investors were outbid by first-home buyers, who tended to be spurred by emotion, he said.

Owner-occupied homes accounted for around 70% of all properties in New Zealand, meaning they had a larger effect on the housing market than investors.

"These points illustrate why attacking property investment would not help first-home buyers to better afford their own home. In fact, the opposite is true. Increasing the cost of providing rental property would lead to higher rental prices, which would make it harder for tenants to save a home deposit," he said.

Building consents out last week confirmed the Canterbury and Auckland regions would lead new residential building this year while the rest of New Zealand remained flat.

Statistics New Zealand figures showed consents for 1520 new homes and apartments were issued in September, a 22% increase on the same month last year and virtually the same number as issued in August.

Registered Master Builders Federation chief executive Warwick Quinn has been predicting a "tale of two cities" for some time.

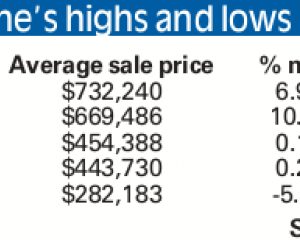

Housing pressures in Auckland and Canterbury were also driving up property values, he said.

Those were the only regions in New Zealand that had rising prices, which generated greater levels of building activity to meet a shortfall in supply. The rest of New Zealand had flat property prices and similar levels of building activity.

"There has never been a better time to build, with low interest rates and a highly competitive market, but this window will close once the Canterbury rebuild starts in earnest and the economy picks up again," he said.