Governor Graeme Wheeler issued a financial stability report yesterday which said while the financial system remained sound, developments in private sector credit and the housing market pointed to increasing risks to financial stability in New Zealand.

Housing prices were increasing risk in the financial system.

''House prices relative to disposable incomes are already high by international standards. Further price escalation will worsen the potential damage that could result from a housing downturn following an economic or financial shock.''

The Reserve Bank's concerns were shared by the OECD and the International Monetary Fund in its recent review of the New Zealand economy, he said.

Housing risks had also been noted recently by all three of the major international credit rating agencies.

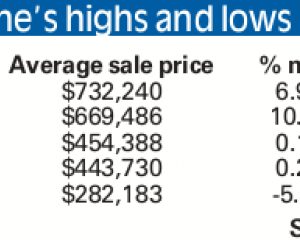

Housing pressures, arising from pent-up demand, limited supply and the lowest interest rates in 50 years were being felt particularly in Auckland and Christchurch, where supply constraints were the greatest, Mr Wheeler said.

Demand was being underpinned by easier credit conditions, both in terms of lower mortgage rates and an increased willingness by banks to lend on high loan-to-value ratios (LVRs).

A strengthening of global financial market sentiment in recent months was contributing to easier conditions by reducing bank funding costs and making offshore funding more readily available.

Global sentiment was also contributing to New Zealand's overvalued exchange rate, which was continuing to hinder a rebalancing of activity towards the tradeables sector that would assist in reducing vulnerability to overseas events, he said.

The dollar, which had gained 11% from its lows a year ago on a trade-weighted basis, was ''significantly overvalued''.

The Reserve Bank said later it intervened in foreign exchange markets in an attempt to drive the kiwi lower. It gave no details of the size of the intervention.

With the credit cycle now turning upwards, there were signs that the post-global financial crisis recovery in household savings might be stalling, Mr Wheeler said.

''Household debt is rising from a level that is already high, relative to incomes.''

The bank expected to sign a memorandum of understanding with Finance Minister Bill English soon to add macroprudential tools to its interest rate lever in keeping inflation tame and the economy on track. It stood ready to impose loan-to-value limits on the riskiest mortgage lending should it be deemed a ''significant risk'' to New Zealand's financial stability, he said.

Leverage in parts of the agricultural sector also remained high and borrowing by the sector was increasing at a time when recent drought conditions could expose financial vulnerabilities for some farmers, Mr Wheeler said.

Westpac senior economist Michael Gordon said the financial stability report was dominated by the announcement that the four major banks would be required to hold a higher minimum level of capital against mortgages with a loan-to-value ratio above 80%.

''While the decision wasn't entirely new - there was a brief public consultation period from late March - we suspect there was a low level of awareness in the market about this proposal.''

The increase in the capital requirement was not strictly part of the Reserve Bank's suite of macroprudential policy tools in that it would not be adjusted over the economic cycle. However, it would work in much the same manner and, with the housing market continuing to heat up, the timing was no coincidence, he said.

The main benefit of the policy, which was no substitute for the official cash rate, would come from ensuring lenders had a sizeable buffer to deal with losses in the event of a severe downturn.

Financial markets did not move following Mr Wheeler's report, other than a small drop in the New Zealand dollar against the Australian currency. That probably reflected the standard comments about the overvaluation of the New Zealand dollar, Mr Gordon said.

At a glance

• Reserve Bank to increase risk weight on high LVR mortgages from September 30.

• Decision follows a brief consultation period.

• Reserve Bank remains concerned about risks from rising house prices.

• Borrowing in agricultural sector remains high.