The university investment sector in Dunedin finished the year with a flourish in the fourth quarter, but overall sales volumes were down 13% for the year.

The rise of a ''new generation tenant'', demanding better quality flats and prepared to pay for it, has stimulated several developments and triggered renovations being done to a higher standard.

In Colliers International quarterly report on Dunedin's university sector, university investment broker Matt Morton said Reserve Bank confirmation of low interest rates holding would continue to stimulate buyer activity.

''We expect to see the large interest from out of town buyers continue as their respective markets in the North Island and Australia offer low yields, comparative to our market,'' Mr Morton said.

However, he highlighted there is a ''tighter insurance criteria'' at purchase time which was now ''here to stay'' and buyers were continuing to complete detailed due diligence on prospective properties before signing off.

''The days of purely yield driven prices are gone. Tenants will not simply rent anything and the insurance companies will not just insure anything,'' he said.

He said there were also other ''fresh challenges'' for investors. Tenants continued to demand better quality flats and were prepared to pay higher rents for them.

Several developers were responding with new build multi flat properties which will be on offer during 2015, in the campus and city areas.

''Many investors have also been busy over the summer renovating existing properties, responding to the quality demands of the new generation tenant,'' he said.

Mr Morton said there was a ''flurry'' of activity towards the end of last year. Sales were up 40% compared with the previous quarter and he noted that eight of 18 sales sales in the campus area were more than $500,000, ''fuelling investor confidence''.

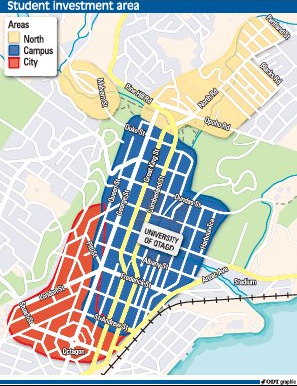

While the general price of student property appeared to have increased, Mr Morton said the three areas: north, campus and city, were quite different in tenants, rents and yields.

The campus area performed better in 2014 than 2013, sales volumes being ''slightly up''.

There was a ''significant'' lift in annual median price, from $388,000 to $420,000 in 2014, but median yields were down from 7.33% to 7.02%, because of more sales closer to the university which were low yield and more sales of upper end valued residences.

''About 40% of sales in 2014 were over $500,00, compared to 20% in 2013,'' Mr Morton said.

He said in the north sector, where properties generally sold and rented for less, sales volumes plunged from 70 in 2013 to 38 last year and it was the main contributor to the overall annual decline from 151 sales in 2013 to 131 sales in 2014.

A larger number of sales under $200,000 dragged down the median price by $32,000 to $205,000, he said. However, median yields were about 8.5%, a slight lift from a year earlier.

The smaller city sector consistently sells about 25 properties a year. Rents were slightly lower than campus and yields variable, generally in lower to mid 7% range, Mr Morton said.