A $56 million lawsuit over Queenstown's Hilton Hotel site has taken a twist.

The receivers of Nigel McKenna's Kawarau Village empire, which had a $2 billion vision but collapsed in a mountain of debt in 2009, are suing Singaporean businessman David Yuen over a guarantee to buy apartment units.

Mr Yuen's company, known as Austpac, was required to buy units when buyers defaulted.

But Mr Yuen says the agreements were cancelled because the developer breached the agreement's terms, including allegations it used inferior building materials and finish.

In a High Court judgement released earlier this month, Associate Judge Roger Bell gave Mr Yuen until mid-August to inspect the buildings and compare them with draft plans and specifications.

The decision said: ''This period will allow him to instruct an appropriate expert witness to inspect and report.''

The judgement also dealt with several issues of document disclosure.

Associate Judge Bell ordered Kawarau Village Holdings Ltd to go through documents relating to the alleged downgrade in materials and finish.

''That will include decision-making documents: they are relevant as going to the significance of any changes made.''

The court also ordered the release of documents relating to changes in the operator lease and the transfer of what was meant to be commonly owned property into private title.

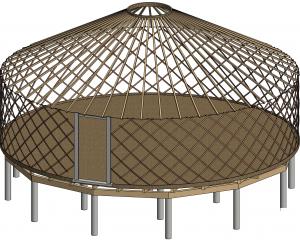

The $2 billion vision for Kawarau Falls Station was for a world-class resort, with 13 hotel and serviced apartment complexes.

Stage one of the complex was completed - residential apartments and serviced apartments run as Hilton Queenstown and DoubleTree by Hilton Queenstown.

As revealed by the Otago Daily Times last November, the Kawarau Falls complex is now owned by Chinese billionaire Jiang Zhaobai, of Shanghai Pengxin Group.

Property developers Chris and Michaela Meehan snapped up the neighbouring site from the receivers. The Lake's Edge development, which has 23 of 34 lots sold, has one lakeside section on the market for $1.5 million.

Earlier this year, Singaporean and Malaysian buyers of units at the site failed in their legal bid to have their deposits returned and were stung for $36 million in damages.