Peter Lyons wonders if a grand 30-year global economic experiment is coming to an end.

Ideas matter. They shape our perceptions of reality and this determines our actions.

Economic policy is a battleground of ideas.

The battle lines are clearly drawn in the present global environment and the stakes are very high.

A defining feature of the opposing camps is the role of government in a free-market economy, particularly during times such as this.

All mainstream economic thinkers agree free markets are generally the most efficient means for a society to determine how to use its resources to ensure the maximum welfare for its citizens.

However, mainstream economics is also clearly divided into two camps.

Nobel prize-winning economist Paul Krugman labels the two camps freshwater economists and saltwater economists.

Freshwater economists believe markets always work. The role of government should be limited to providing basic public services, ensuring inflation is kept under control and maintaining a balanced budget.

Recessions are the result of markets' failing to clear due to rigidities that need to be removed.

Unemployment is the result of people's unwillingness to accept lower wages in order to gain employment.

During tough times, with the supply of labour exceeding demand, wage rates should fall and firms will employ more workers.

Governments can solve unemployment by making the market for labour more flexible.

This is a euphemism for reducing union power, promoting individual contracts, encouraging the unemployed to seek jobs at any wage and, in the extreme case, slashing the minimum wage and benefits.

During recessionary times, solutions should be left to markets and central bankers, according to the freshwater school.

During such times, monetary policy requires interest rates to be cut, as inflation is unlikely to be an issue.

Lower interest rates will ensure increased demand in the economy, leading to increased output and employment.

Monetary policy can be used to fine-tune the economy but activist government approaches in the form of tax and spending policies are ruled out.

Freshwater economists believe in a concept called the efficient market hypothesis.

This states that the prices of financial assets such as shares and bonds and, more recently, houses, reflect the rational decisions of millions of market participants.

Borrowers and lenders are fully informed and rational in their decisions.

There is no such thing as contagion or herd behaviour, because we are all independent, rational thinkers.

As Margaret Thatcher once famously stated, "There is no such thing as society." People do not sit around at dinner parties talking about what the house next door sold for.

Many freshwater economists also believe in a concept called Say's law.

This law states that for an economy, the total supply of goods and services will always ensure adequate overall demand for what is produced.

The incomes created by the production of goods and services will ensure enough demand in an economy to buy these goods and services.

For this reason, an economy will tend to full employment, provided markets are left to operate freely.

Freshwater economists have dominated the profession for the past 30 years.

During recessions, central banks have slashed interest rates to stimulate demand, allowing people to borrow and spend more.

As a result, in the past 30 years, the level of private debt in most Western societies has skyrocketed. Unfortunately, this approach is not working this time, either here or abroad.

The potion has lost its magic.

Consequently, this is not a normal "run-of-the-mill" recession.

Saltwater economists believe that during such an extreme time there is a role for activist government policy in the form of expansionary government tax and spending policies.

This is essential to maintain total demand in an economy and prevent a deflationary spiral, as occurred during the 1930s Depression.

Saltwater economists do not believe markets always achieve the best outcomes for society, particularly in the area of finance.

The name Hyman Minsky has become prominent in economic literature since the collapse of 2008. Minsky believed asset bubbles occur at periodic intervals.

His idea was that an asset class such as shares or housing could morph into a speculative bubble.

A boom time in an economy could lead to a rise in asset prices as demand temporarily exceeds supply.

Word quickly gets round that you can't go wrong by investing in shares or property - or tulips, as occurred in Holland in the 1600s.

The rise in asset prices leads to increased bank lending as the value of people's collateral increases.

This creates a surge in general economic activity, as people feel wealthier due to higher asset prices.

This leads to higher employment and further borrowing and spending.

The illusion of prosperity continues until the asset bubble eventually bursts. Then the process reverses.

Saltwater economists also believe that during extreme recessionary times, an economy that is left to markets can limp along with high unemployment and low or negative growth for a very long time.

The social costs can be enormous. A central bank cutting interest rates has little effect because in such times people are scared to borrow and are desperately trying to pay down debts.

Firms are also unlikely to borrow to build more capacity because they are struggling to sell their output.

Monetary policy becomes ineffective.

Policies designed to reduce wage rates to encourage more employment will lead to a deflationary spiral. Wage rates may fall but the debts accumulated during the boom times remain.

It becomes harder and harder for people to pay their debts.

The economy falls into a vicious downward deflationary spiral.

Rising unemployment leads to falling demand and asset prices, which leads to greater unemployment, which makes it harder for people to pay off their debts.

This is the present sad fate of Spain, Greece and Ireland. The human cost is enormous.

Economic policy in New Zealand has been dominated by freshwater economic thinking.

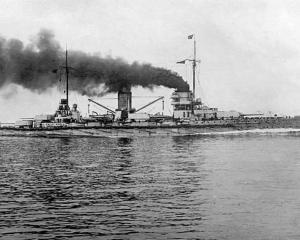

Markets know best. The Government's stance of aiming to balance its budget by 2014 resembles the captain of Titanic obsessing about tidying his cabin as the ship drifts along in dangerous waters in the dark of night.

Peter Lyons teaches economics at Saint Peter's College in Epsom and has written several economics texts.