Rio Tinto Alcan's Bluff aluminium smelter cut production by just under 3000 tonnes a month early last month, to avoid buying power on the spot market in addition to its long-term contract supply from Meridian Energy.

New Zealand Aluminium Smelters general manager Paul Hemburrow said the smelter was designed to run constantly and reducing production was costly and disruptive.

"This is the fourth time in seven years that we've gone through reductions of this nature and I guess we've got to manage our process best as we manage this. Our process works best when we've got consistent raw materials and energy."

Savings had already been made by cutting 66MW of power use - the equivalent of 600,000 homes reducing power by 10%.

The smelter has a deal for the bulk of its power until 2030, but quit buying on the spot market when the price was a little over 20c/kWh.

With spot prices still lurking above 30c/kWh the smelter would not be buying any time soon.

"It's miles off the mark now. We can't afford to operate at the levels it's currently running," Mr Hemburrow said.

The smelter's fixed contract price was set annually and was linked to spot prices.

"The current conditions have an obvious impact," he said.

Meridian says it is in "an ongoing dialogue" about what further savings the smelter could make.

One of the country's other big spot power buyers, Pan Pac pulp and paper mill near Napier, has shut down three of five of its pulping machines.

Mill general manager Fred Staples said the company had to give up developing some business in China and India because it could not match the marketing effort with production.

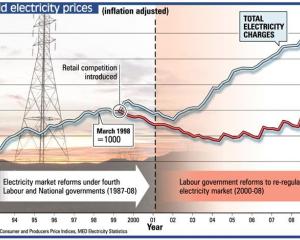

"We're pretty concerned. We think the whole market is pretty dysfunctional."

New Zealand's biggest company, Fonterra, said it was feeling the impact of increasing energy prices.

A programme in place for the past five years had helped achieve energy savings of more than 10%.

Fonterra's own generation can feed power back into the national grid - a decision made with its partners.

The Major Electricity Users Group is also worried about the spillover from record spot prices.

"It's just not those on the spot, because it also affects those who are on new hedges . . . All consumers are going to be paying for the high costs," said the group's executive director, Ralph Matthes.

The spot price at Haywards during May averaged 27.2c/kWh. The previous highest average monthly spot price was 23.7c/kWh in July 2001.

Large commercial customers, especially those in central Auckland who suffered during the 1998 cable failures, would now wonder if there would be a full-blown crisis this winter. Confidence had been eroded, Mr Matthes said.

"All of that is chewing up management time and causing anguish. All of that flows through to potential investors in businesses."

Mr Matthes said there were questions over whether the threat of shortages justified the premium built into spot prices.

He was also worried about the time taken to get a formal savings campaign under way.

"The industry response has been a lot slower than 2003. There is something in that but there's a bit of politics getting in there."

The Government should now be removing constraints to build gas-fired power stations around Auckland, particularly given the Rugby World Cup and the consequent surge in visitors and focus on this country, was just over three years away.

"It is grim. We haven't had a run of good luck. You don't want to bank on our luck changing." - Grant Bradley.