Air New Zealand has today announced earnings before other significant items and taxation of $198 million for the six-month period ended December 31, compared to $217m in the prior period, reflecting the slower demand growth environment, weakness in the global cargo market and the ongoing unrest in Hong Kong.

Earnings before taxation were $139m and net profit after taxation was $101m, down from $152m.

The airline has maintained an 11c dividend for the half year.

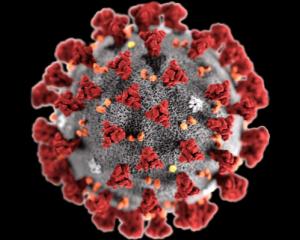

Chairwoman Dame Therese Walsh says management continues to execute the strategy that was first communicated to the market almost a year ago, while quickly adapting the business to the evolving situation surrounding the Covid-19 outbreak.

"Our capacity discipline on existing routes, stimulation of leisure traffic with the domestic fare restructure and entrance into attractive new international markets has driven good revenue performance in the first half. Alongside our focus on profitable top-line growth, we are on track to deliver the long-term sustainable cost savings target from our business review initiatives.

"While the Covid-19 situation is dynamic, we have taken immediate steps to mitigate the impact of softer demand and I am confident that we have the ability to manage the expected short-term impacts effectively."

The airline reiterated guidance it released on Monday, saying that while the situation is uncertain, based on current assumptions of lower demand as well as the benefit of the announced capacity reductions and lower jet fuel prices, the airline currently expects a net negative impact to earnings in the range of $35m to $75m as a result of Covid-19.

At the midpoint of the estimated range above, which is approximately $55m, the airline is targeting earnings before other significant items and taxation to be in a range of approximately $300m to $350m.

The airline says it will provide an update to this guidance should the current assumptions materially change.

Its shares have slid by 23% since the beginning of the year and this morning will start trading at $2.40.

As part of network cuts, the airline has previously announced it would cut its newly relaunched Auckland-Seoul service from March 7 through to the end of June in addition to cuts to Shanghai and Hong Kong services. Total Asia capacity will be cut by 17% to the end of June.

Tasman capacity will be cut from March through to the end of May by 3% focused on Auckland-Sydney services with some changes to Auckland-Melbourne and Auckland-Brisbane.

Domestic capacity reductions of 2% are focused on services between Auckland and Christchurch and Auckland and Queenstown.

Chief executive Greg Foran started at the start of the month and said challenges presented by the Covid-19 outbreak showed the resiliency of the airline and its ability to respond quickly to changing market conditions.

Staff had been working around the clock to manage the impact of the outbreak on operations.

''Our business is resilient, and we have demonstrated the ability time and again to respond quickly to changing market conditions. We have a highly capable and experienced senior leadership team who have dealt with challenges such as this before and I am confident that we will effectively navigate our way through this," he said.

The airline was better able to manage the cost implications of making late changes to its network and could redirect its most efficient aircraft, the Boeing 787 Dreamliner, to other parts of the network.

The airline said operating revenue growth of 3% was driven by solid demand across the airline's Domestic and Pacific Islands networks, as well as recently launched services into Asia and North America. This helped to mitigate weaker cargo demand, increased competition on the Tasman and the impact of disruptions in Hong Kong.

Operating costs increased 3.5% in the period, impacted by significant price increases in domestic air navigation and landing charges, as well as a weaker New Zealand dollar.

Maintenance costs for third party contracts also increased, however this was more than offset by the related revenues. Fuel costs increased 1.1%, as an improvement in the underlying fuel price was offset by foreign exchange and fuel volumes resulting from growth in the International network.

Ownership costs increased by 7.1%, driven by the arrival of new, efficient aircraft including the airline's 14th Boeing 787-9 Dreamliner in a premium-heavy configuration.

Qantas last week said its profit could be hit by up to $156m and cut capacity across the Tasman. Virgin Australia has also cut capacity between New Zealand and Australia as the airline industry faces the steepest drop off in demand since the 9/11 terror attacks.

In the United States, American Airlines shares hit a six-year low this week and United Airlines has not given guidance on future earnings because of uncertainty.

Figures on the forecast global airline impact from the International Air Transport Association said the bulk of losses would be borne by airlines in China, with $12.8 billion expected to be lost in the China domestic market alone.

In December, IATA forecast global revenue passenger kilometre growth of 4.1%, so this loss would more than eliminate expected growth this year, resulting in a 0.6% global contraction in passenger demand for 2020.

Ahead of Air New Zealand's announcement today, the airline outlined details of a new lie-flat bed, Economy Skynest. It hopes to have regulatory approval soon and is in the midst of assessing its commercial viability.