But now a local housing trust is offering 25 apartments for the same price they cost to build.

The catch - you won't be able to sell the property on the open market or transfer it to anyone else.

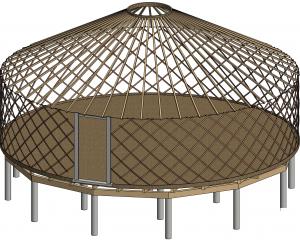

The apartments at the Toru development in Frankton will finally start to eat into the growing waiting list of those needing help from the Queenstown Lakes Community Housing Trust.

The trust's executive officer, Julie Scott, said the apartments were priced at numbers considered affordable wherever you lived in New Zealand, but especially in Queenstown.

"Under our leasehold model, the households are buying in at around 50 percent of what it cost us to purchase the unit from the developer. So some of those one-bedders are down as low as $200,000," she said.

The average two-bedroom unit cost about $320,000.

The 25 apartments were part of the Secure Home programme. Households essentially bought the construction costs and paid a ground rent of 1 percent of the land value, about $40 to $50 per week.

The Toru apartments were the cheapest homes the trust had ever offered, Scott said.

"They are one and two-bedders, whereas historically we've built more standard three-bedroom homes so they've been a bit more expensive and that's reflected in the purchase price. So this changes the people we are able to help."

The apartments were not freehold.

The trust offered a 100-year lease which cannot be transferred or sold on the open market, but if families wanted to move the trust would buy the house back at the original purchase price, plus inflation. The home could then be bought by another applicant on the trust's waiting list.

Scott said applicants who were eligible for the government's First Home Loan would only need a 5 percent deposit, making the programme even more affordable.

"You're talking potentially about having a $10,000 deposit and getting a mortgage of $190,000 can get you into your own home," she said.

"Then you're paying off your own mortgage rather than your landlord's mortgage in a rental situation so it's a really good outcome for people."

Queenstown Lakes District Mayor Jim Boult said it had been a long time since someone could buy their own home with a $200,000 mortgage in the town.

"I've been here for 39 years so I do go back to when a couple of hundred thousand dollars was a good size mortgage, but certainly in the last 20 years there's been nothing like this available. These are also quality houses as well, it's not something that's been put together cheaply. These are well done, well put together and well designed."

This year the trust also planned to begin development of more than 60 homes in nearby Arrowtown.

Boult said it demonstrated the work of the Mayoral Housing Affordability Taskforce coming to fruition.

The taskforce formed in 2017 to ensure the district's entire workforce would be able to own or occupy a home in the district at a cost that allowed them to live within their means by 2048.

"We had a target of getting 1000 affordable homes built in the district by 2028 - 10 years after the taskforce finished it's work - and we are well on track towards that," he said.

Of the trust's 25 Toru apartments, 15 had already been allocated but the trust still wanted to hear from applicants for the remainder.

The trust also owned another 15 apartments which would be put into public housing, while another 10 would be sold on the open market or offered as rentals.