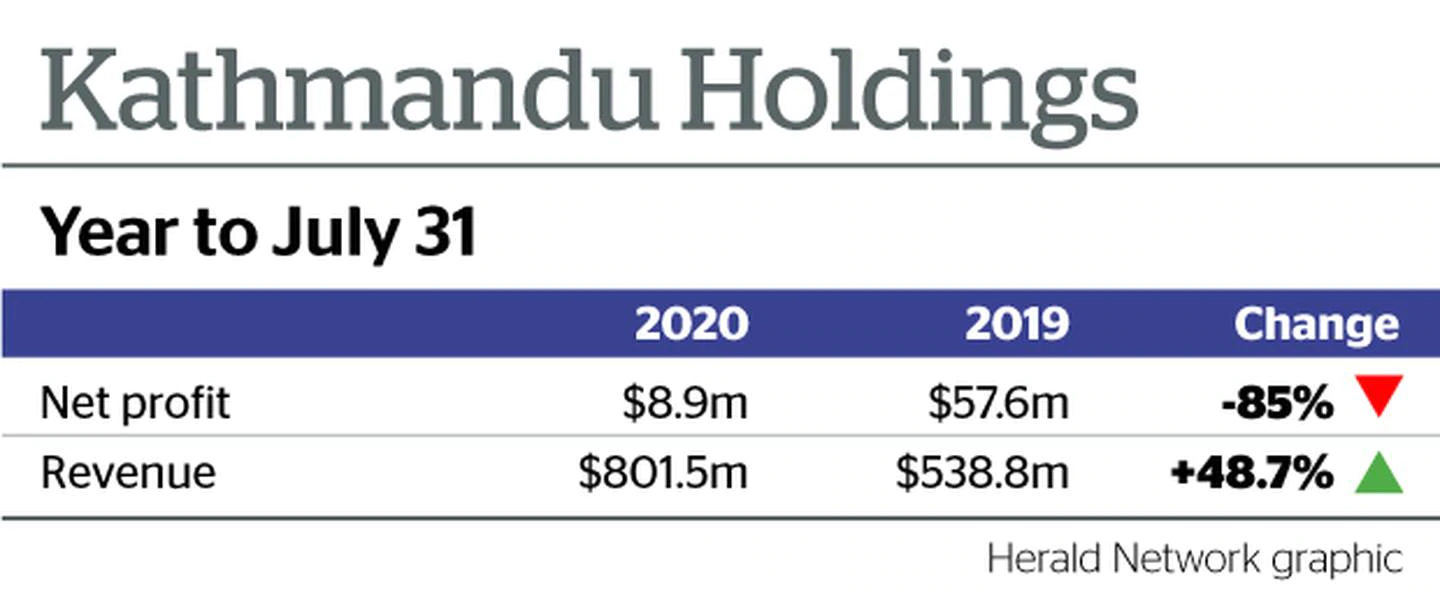

The outdoor clothing and equipment retailer posted a net profit of tax of $8.9m in the 12 months to July 31, compared to $57.6m a year earlier. The company said the stark drop in earnings reflected an $18m one-off transaction cost for the acquisition of surf brand Rip Curl, a $4.6m restructuring cost and a further $2.6m leasing cost.

Kathmandu group sales were up 48.7 per cent to $801.5m in the period, compared to $538.8m a year earlier, and included nine months of earnings from recently acquired surf brand Rip Curl.

It posted earnings before interest, tax, depreciation and amortisation (ebitda) of $149.8m, up from $99.5m reported in the same period a year earlier.

Kathmandu will not pay out a final dividend. The company said Covid-19 had resulted in an approximate $135m loss of sales for the group.

Total online group sales grew by 63 per cent to $106.4m in the year, now accounting for 15.7 per cent of all sales.

Kathmandu's online sales grew by 67 per cent to $80.9m in the period, while Rip Curl online sales grew by 52 per cent to $25.5m.

Including online and in-store sales, total group sales increased by 48.7 per cent.

Kathmandu group chief executive Xavier Simonet said FY20 had been a "transformational year" for the company following the Rip Curl acquisition. But the group had bared the brunt of the Covid-19 pandemic which had impacted its results.

Despite this, he said the company was in a strong financial position.

"Unfortunately the group faced significant unexpected challenges with Covid-19 restrictions and lockdowns. We took decisive action early to reduce costs, adjust the operating structure of the business, and raised $207 million of equity. These initiatives have resulted in a strong balance sheet and healthy inventory level, which position us well for the future," Simonet told the NZX.

Following lockdown restrictions easing in New Zealand, Australia, Europe and California, the group had seen its retail sales return strongly.

"Both Rip Curl and Kathmandu also enjoyed an exceptional post-lockdown winter sales performance in Australia and New Zealand," Simonet said.

The company said Covid-19 had resulted in loss sales in the Rip Curl business of about $70m and about $15m in the Oboz business.

Lockdowns had caused loss sales revenue of about $50m from Kathmandu stores.

Rip Curl sales declined by 17 per cent, but it still generated $34m of cash and contributed $11.7m to group underlying EBITDA during the initial nine months of ownership.

"Beyond the short-term impacts from lockdowns, our long-term strategy remains unchanged," Simonet said.

"Product innovation, brand differentiation, a key focus on sustainability, and a step change in digital transformation, will enable us to continue answering the needs of our customers."