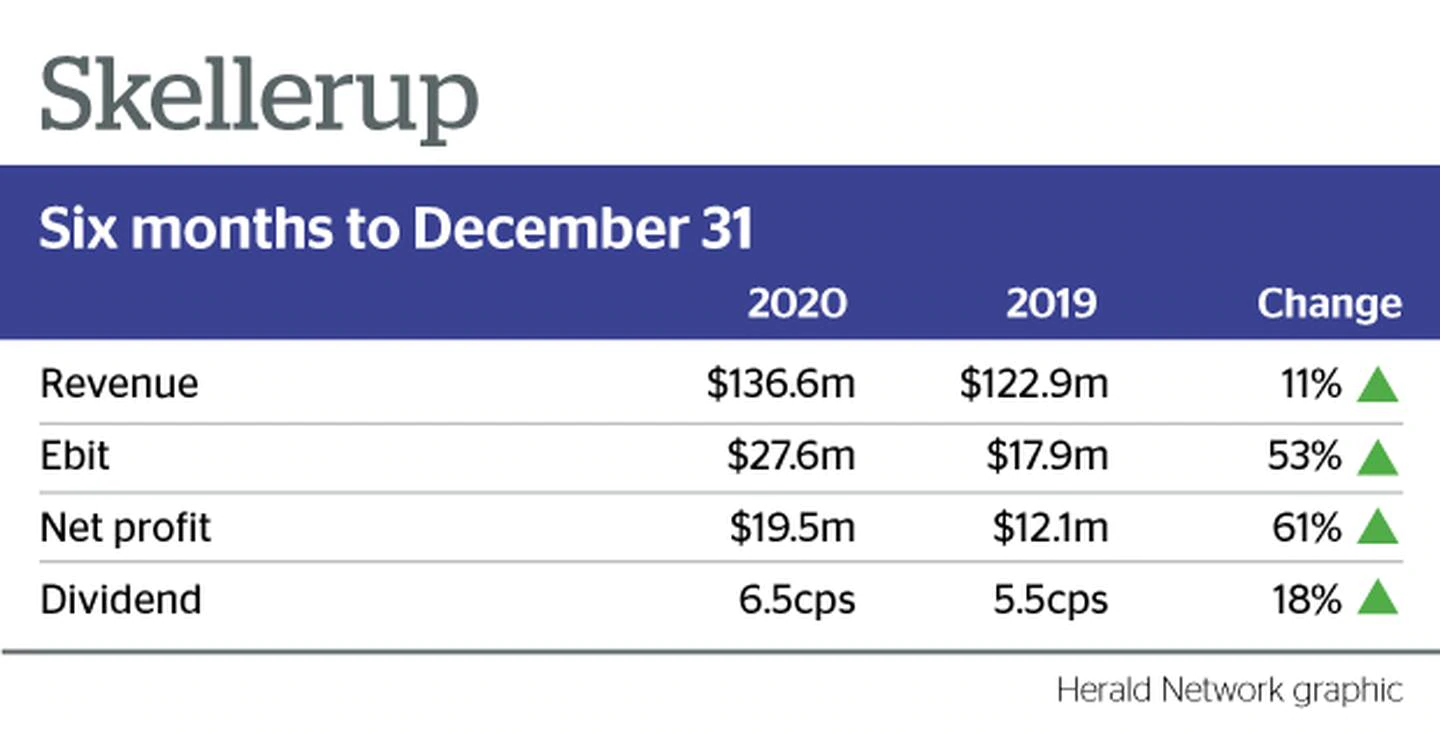

Skellerup's revenue rose 11 per cent to $136.6m for the six months to December 31, and earnings before interest and tax came to $27.6m - up 23 per cent on the previous corresponding period.

The unaudited net profit was up 61 per cent. The company declared an interim dividend of 6.5c a share, up 1c on last year.

The company was founded by George Skellerup in 1910 when he opened his first retail store in Christchurch then called Para Rubber Company.

Based in Christchurch, Skellerup Industries Limited (SIL) employs around 200 people and sells its product throughout the world with its largest export market into the US. SIL is part of the Skellerup Holdings Limited Group of companies which is listed on the NZX stock exchange.

Operating earnings from Skellerup's agri division rose 56 per cent to $15.3m while earnings from the industrial division climbed 52 per cent to $15.5m.

Chief executive David Mair noted the first-half profit was boosted by about $500,000 because of the impact of Covid-19 and Brexit.

"Production constraints caused by Covid-19 caused some deferral of sales from the prior year into the first half of the current year. In addition, uncertainty over Brexit-related disruption saw some customers increasing purchases in December 2020 providing an additional earnings boost for the first half of FY21.

"Our leaders continue to lead and manage around the impacts of Covid-19 very well. We have seen some project timelines for new products extend but despite this, we have successfully moved into production with new products and customers in Australia, the USA and Europe."

"We continue to work closely with customers to clearly understand their requirements and challenges to rapidly develop and deliver prototypes followed by standards-compliant product."

Agri division revenue grew 18 per cent with increased dairy rubberware sales in international markets, particularly Europe, increased rubber footwear sales in New Zealand and a full six-month contribution from Silclear (acquired in November 2019).

"We have made further improvements in the efficiency of our operations at Wigram," Mair said.

"Improvements in cycle times has enabled better inventory management to smooth out the peaks and troughs of manufacturing and changes in shift patterns have been key and delivers sustainable earnings improvement."

Revenue from Skellerup's industrial division grew 7 per cent, reflecting increased sales of roof flashing and plumbing products in Australia and U-Dek marine foam decking in the US, Europe, Australia and New Zealand.

Corporate costs of $3.3 million were up $1.3 million because of provisioning for costs associated with defending a claim against a business Skellerup sold in 2008 and increased performance-related employee expenses.

Outlook

Skellerup has revised up its full-year expectations, now forecasting net profit in the range of $33 million to $37 million, up from $30 million to $35 million advised in October last year.

"We are experiencing extended shipping times and increased freight costs because of to congestion and availability. We have also seen some increases in raw materials and will be impacted by the stronger NZ dollar.

"All of these factors will have some impact in the second half of the year. However, we have taken early steps to manage these risks and will continue to ensure we are able to meet our customers' needs."

Skellerup shares rose 20c, or 4.94 per cent, to $4.25 after the announcement.