Are we a rock star economy, asks Peter Lyons.

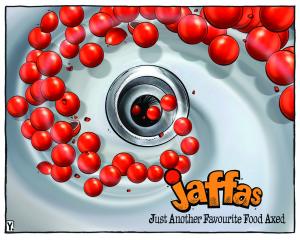

If we are a rock star economy, we are a Justin Bieber rather than a Mick Jagger.

Our celebrity status is unlikely to endure.

A recent hedge fund report out of the United Kingdom suggests our economy is like the Irish economy before the 2008 meltdown.

We seem to have started the new year with unbridled confidence in our economic situation.

The main drivers of our economy are quoted as the Christchurch rebuild and the boom in commodity prices, particularly dairy.

We are doing OK but this does not warrant rock star status.

But it is also unlikely that we compare to the Irish economy before its collapse.

Ireland, before the global financial crisis, had experienced a massive construction boom funded by irresponsible domestic bank lending.

When the crisis hit the construction industry collapsed, creating an immediate spike in unemployment and a collapse in bank liquidity.

The Irish government opted to bail out its insolvent banking sector, creating a massive debt for the Irish taxpayers.

This scenario is unlikely to play out here.

But major fragilities still exist in our economy.

The Christchurch rebuild represents a stimulus to our economy during a period of weak demand.

It is creating jobs and incomes yet it is only allowing us to regain the wealth lost by this calamity.

To suggest that the rebuild represents a growth opportunity for our economy implies that we should destroy our cities on a regular basis to ensure our prosperity.

It would be like a glazier breaking the windows in his house each week to boost his workload.

Economic growth is measured by increases in gross domestic product.

This measures increases in national income and output but does not measure increases in national wealth.

The Christchurch rebuild has huge costs to our economy.

It diverts valuable resources that could be used to build infrastructure and housing in other parts of the economy.

Much of the rebuild is likely to be funded by future increases in insurance premiums for New Zealand households.

It is not a pathway to sustained prosperity.

The dairy boom appears to be continuing largely driven by Chinese demand.

While this is a bonus for our economy it begs a question.

Why, after many decades of painful economic reform, are we still largely reliant on primary exports?

The answer lies in the economic theory we have vigorously pursued over this period.

We have been a staunch advocate of free trade since adopting market policies.

Free trade is based on the assumption that countries should specialise in producing the items in which they have a comparative advantage.

This is usually determined by their resources. Our comparative advantage has historically been in primary commodities because of our relative abundance of fertile land.

It is little wonder that we have landed back where we started almost 40 years ago.

But there is a fundamental problem in specialising in agricultural production.

It suffers from diminishing returns. Eventually, a country runs out of fertile land.

Another problem is that countries that specialise in agricultural commodities are price takers on world markets.

Any advances in production techniques benefit consumers, prices being lowered because of the competitive nature of these markets.

So each year we wait with bated breath for dairy prices set by the world market. We have little control over our economic destiny.

No developed nation became rich by specialising in agriculture or adopting free trade in their early stages of development.

Britain promoted free trade in the mid-1800s only after developing its manufacturing sector, in an effort to expand the market for these products.

Manufacturing and high-tech industries generally experience increasing returns.

As output increases the costs of production per unit fall.

For this reason incomes and profits generated in these sectors as they expand tend to be higher than in agriculture.

The United States is an advocate of free trade but its actual practices are hypocritical.

It pushes free trade in areas such as advanced services and high-tech products and promotes the protection of intellectual property while maintaining protectionist measures in primary products largely for political reasons.

We are not a rock star economy but neither are we a basket case. We remain largely a primary exporter.

This makes us vulnerable to sudden shifts in world markets.

We also have far too much private debt that has been used to bid up the prices of our existing housing stock.

More advanced economies have tended to be less ideological in their approach to economic development.

They produce higher-value-added goods and services that gain increasing returns.

This also gives them greater control over the prices they can charge.

• Peter Lyons teaches economics at Saint Peter's College in Epsom and has written several economics texts.