Call it an inevitable rebalancing or a correction, but the speed with which the growth of the wine industry has come to a halt can only be called spectacular.

Its glamour, mystique and romance attracted a torrent of investor interest, and while the industry could not be considered a train wreck, observers say some vineyards and wineries will be forced to close, and others to amalgamate.

The New Zealand Herald recently reported 134 vineyards were for sale, including 29 in Otago, 55 in Marlborough and 17 in Hawkes Bay.

The industry is not yet at the stage of ripping out vines, but some owners have mothballed blocks and bigger wineries have withheld wine from sale until prices recover.

The average grape price over all varieties fell from $2161 a tonne in 2008-09 to $1629 last season and was forecast to fall to $1293 next season.

In 2006, it was $2022.

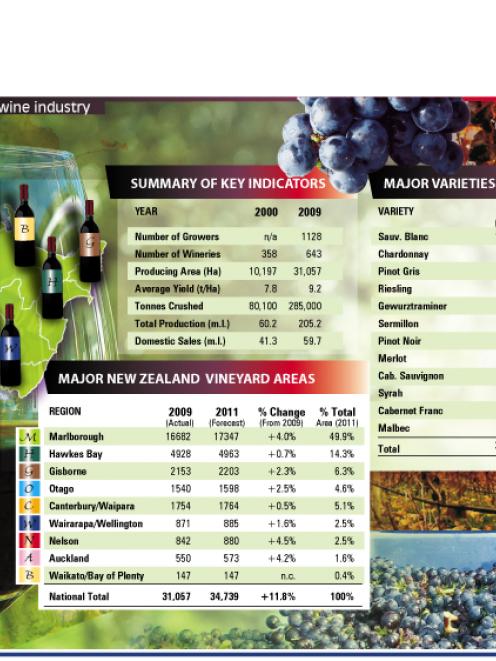

It is a story of remarkable growth, planted areas having grown from 5900ha in 1985 to close to 33,000ha today, and the volume of grapes crushed from 78,000 tonnes to 285,000 tonnes in that same period.

But a perfect storm of the global economic crisis curbing demand, continued growth, and land values in some parts of the country halving has depleted profits, weakened balance sheets and caused several receiverships.

In May this year, pioneer Otago vineyard Gibbston Valley Wines went back to shareholders seeking a second capital injection of $2.5 million, after recording $2.64 million in losses in the previous two years.

Two years ago, Vintners Winery in Cromwell was placed in receivership owing $7.2 million, and in May last year, William Hill Winery faced a similar fate, owing more than $5 million.

Marlborough in particular is being hit hard by the correction.

Last month saw the collapse of Awatere Vineyard Holdings and Awatere Vineyard Estates, contract grape growers to Villa Maria and Montana, which reportedly owe at least $24 million.

The deterioration in the industry's economics was illustrated by the New Zealand Wine Company's recording a $1.9 million loss in the year to June 30 on the back of a $1.2 million profit a year earlier, after what it described as the most challenging year in two decades.

Revenue increased $500,000 to $13 million, but shareholders' equity fell by $3.3 million to $18.63 million due in part to a 13% fall in market valuations of vineyard and winery assets.

The Ministry of Agriculture and Forestry forecast exports in the year to June 30 of 145 million litres, a 30% increase in volume, but the estimated value of $1.1 billion for those exports was only 11% higher than the previous year, the average price per litre falling from $8.70 in 2008-09 to $7.50 this past year.

While New Zealand has sold more wine by finding new markets, France has reduced exports by 19%, Spain by 14% and Australia by 6%.

Deloitte corporate finance partner Paul Munro said a study his firm did in conjunction with New Zealand Winegrowers showed businesses most at risk were those with turnover between $1 million and $5 million.

They were too large to be niche suppliers but not large enough to have the economies of scale of larger businesses or have the wine volume to meet the regular supply demanded by overseas markets.

"The guys in the middle are not big enough, but past the point of being a small backyard family business."

The pressure of battling difficult export conditions for a second successive year would prove too great, he said.

"A number were able to get through one year, but to do it for a second year is more difficult.

"We are seeing it in wine and in other industries.

"The pressure has built, they have done what they can to get cash and strengthen their balance sheets, but this year is just compounding those problems."

Conversely, businesses in the $10 million to $20 million range have been able to retain inventory until markets improve, particularly in white wine varieties.

Mr Munro said the biggest impact came from repricing asset values in light of falling grape prices and land values.

"You don't have to swing the asset value too far to impact on levels of equity."

Domestically, the report said, there had been an increase in sales of wine in the $7 to $10 a bottle bracket and fewer sales of $50-plus bottles.

New Zealand Winegrowers chairman Stuart Smith said the industry was at a critical point as it rebalanced supply and demand, a shift which started with the last vintage.

Last year, 266,000 tonnes of grapes were produced, 7% less than the 285,000 tonnes harvested a year earlier and well short of the potential 310,000-tonne harvest.

In 2008-09, Marlborough sauvignon blanc growers trimmed yields by about three tonnes a hectare but still experienced a 29% fall in the grape price and were expecting a further 2% decline this season.

Mr Smith said reduced harvests had to be repeated for the next two seasons.

"An unexpectedly large vintage in either 2011 or 2012 would undo all that progress.

"It would upset the delicate balance between supply and market demand that we all know is so important."

Mr Smith told the recent Romeo Bragato wine industry conference that markets could only absorb a similar-sized harvest next year.

He described the next two harvests as vital to the industry's future.

Exports of bulk wine have grown from 5% of wine exports to 25%, a worrying trend.

Mr Smith said the industry must continue producing distinctive wines backed by strong branding and continued co-operative investment in marketing.

Exports of bottled wine grew 14% over the same period, a statistic that showed the industry had successfully increased markets and market share.

Exports of pinot noir had broken the $100 million mark for the first time, but Mr Munro said that did not exclude them from the industry correction.

MAF forecast a 3% drop in grape price this year following a 5% decline last year.

Mr Munro said the industry was not going to collapse, and it would recover as people continued to enjoy drinking wine, but money would be lost and business models forced to change with small and medium wineries forced to merge and some industry consolidation.

"The industry will survive, but there will be some individuals fall out along the way."