Content Marketing: Over the past month, the New Zealand Dollar (NZD) has had some mixed movements. While it’s remained relatively stable against the Australian Dollar, it has dropped over the past four weeks against the popular currencies such as the Euro and US dollar.

The graph below shows how the NZD has gone from 73c to 69c recently.

While it’s difficult to know if the NZD will continue to fall, if the trend continues businesses will be faced with new cost pressures unless they raise prices, which isn’t always possible.

One solution can be to pre-purchase goods or agree to future pricing in NZD. There are also services for businesses that allow companies to hedge against currency fluctuations at a fee. The key issue with these options is of course the NZD trend may reverse and the currency gets stronger.

Businesses need to at least consider currency movement as part of their short and long-term business plan.

General tips for purchasing goods/services overseas

While it’s difficult to give generalist advice in regards to how businesses should address currency fluctuations the same isn’t true to transferring money overseas.

Justin Grossbard from compareforexbrokers.com explained that the one rule all businesses should follow is not to use their local bank when paying overseas invoices.

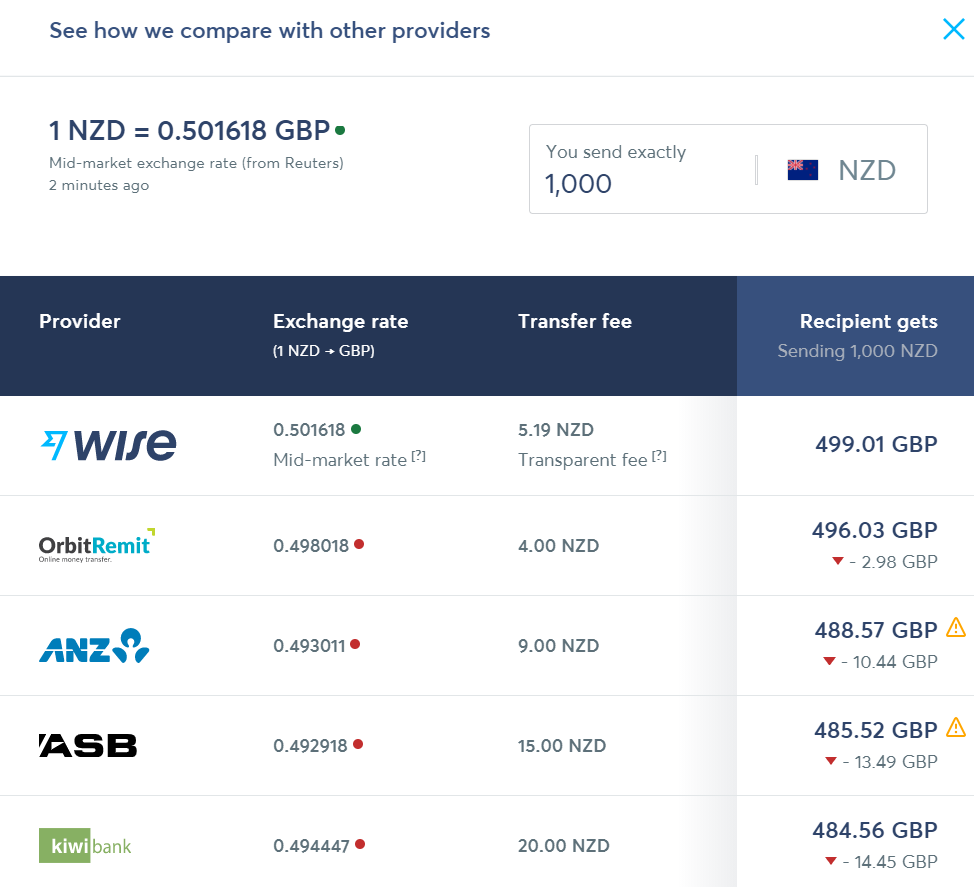

Justin explained that banks provide a poor exchange rate and often have high transfer fees. Specialist services such as OFX or TransferWise offer significant savings and as an example, he provided an example of a $1,000 NZD payment to a British Pound (GBP) bank accounts.