If elected, the party would lift the bottom, middle and top tax thresholds in a bid to "let Kiwis keep more of what they earn".

The overall size of National's plan is $10 billion over five years and will be paid for by using the unallocated portion of the Government's Covid-19 fund and by spending less money than a Labour Government would over the same period.

But National has walked back its previous promise to get Government debt down to 30 per cent of GDP by 2030 – today revealing that target was "not practical or feasible".

"Today, we are facing the biggest economic downturn that world has seen in living memory," National leader Judith Collins said.

"To keep our economy ticking, New Zealanders need money to spend."

That spending, according to the party's policy, will be largely driven by temporary tax cuts.

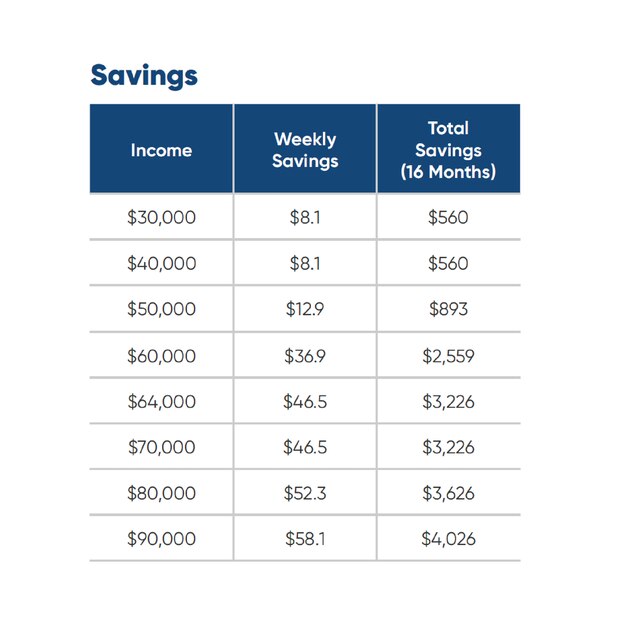

Under National, the bottom tax threshold would be lifted from $14,000 to $20,000, the middle bracket would rise from $48,000 to $64,000 and the top tax threshold would be lifted from $70,000 to $90,000.

But these tax cuts are only temporary, coming into effect on December 1 this year and expiring on March 31, 2022.

Collins said the policy would put about $3000 a year, some $50 a week, to middle-income earners.

Last week, Labour promised that it would create a new tax bracket – 39 per cent for those earning $180,000 a year.

National estimates the tax cut policy would cost $4.7 billion over that 16 months period.

The party has also announced a policy which would, according to finance spokesman Paul Goldsmith, get businesses "spending like crazy".

That plan includes doubling the deprecation rate for businesses which spend money on a new plan, more equipment and any new machinery over the next year.

This brings forward the amount a businesses is able to claim in deprecation for new investments – it is expected to cost $1.7 billion over five years.

Meanwhile, National has promised it would not cut any Government spending on health, education or social development, while keeping a $10.2 billion spending buffer over the next four years to deal with "any future cost pressures".

National has been criticized by Labour in the past over its plans for spending.

Finance spokesman Grant Robertson said that National was caught in a "Bermuda Triangle" were it wants to increase spending, reduce revenue and cut debt all at the same time.

"You can't do all of those things at once – I think their plan is lost somewhere in that triangle."

National did concede today that its plan to reduce Government debt to 30 per cent of GDP by 2030 was not realistic.

It is now targeting 35 per cent of GDP by 2034 – its billions of dollars more in wiggle room.

But National's debt payment plan still has the party paying back and extra $74 billion by 2034 than the current plan.

National has also forecast that, if it's in Government, it would have the books back into surplus by 2027.

Under the Pre-Election Economic and Fiscal Update (Prefu) released yesterday, the Government would continue to be in deficit until at least 2034.

And although it has promised to spend $4 billion of the Covid-19 contingency fund on its temporary tax cut plans, it has also promise it would not spend $5 billion of the so far unallocated $14 billion.

This, according to Goldsmith, would help the party pay down debt quicker.