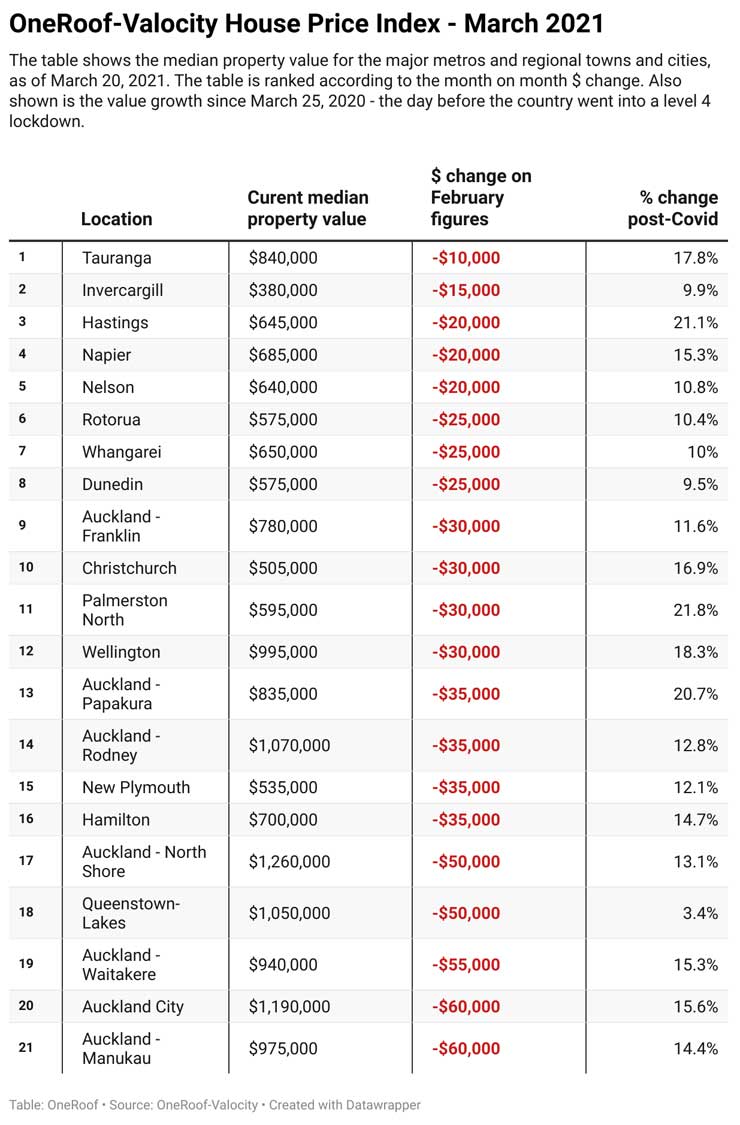

The latest OneRoof-Valocity figures, covering the month to March 20, show an easing of price growth, as buyers and sellers came to terms with new loan to value ratio restrictions, which came into effect on March 1.

While prices in every region and territorial authority were up significantly on pre-Covid levels, with Queenstown notably bouncing back into positive territory, month on month value changes painted a different picture.

The nationwide median property value for March of $735,000 was a retreat of $30,000 on February levels, with Christchurch falling $30,000 to $505,000, while Auckland suffered the biggest fall. Its median value of $1.05 million was a $50,000 drop on the month before.

This trend seems supported by changes at a territorial authority level, with Manukau in South Auckland - a hot-bed of investor purchases before the return of the LVRs - dropping $60,000 to just below the million-dollar mark.

Also dropping out of the million-dollar club was Wellington, where post-Covid price gains retreated $30,000 to $995,000 in March.

Of the major metros, Tauranga fared the best, dropping only $10,000 month on month to $840,000. Dunedin's median value slipped $25,000 to $575,000; Hamilton dropped $35,000 to $700,000; and Queenstown was down $50,000 to $1.05 million.

Only Hurunui, in Canterbury, Otorohanga, in Waikato, and Lower and Upper Hutt, in Greater Wellington, were resistant to slowdown pressures.

OneRoof editor Owen Vaughan said: "Overall, the housing market is still performing strongly, as the figures measuring growth post-Covid show. It's when we look at the month-by-month changes that weaknesses in the market become apparent. While there is a certain amount of volatility in the monthly figures, there are signs that growth has slowed and that Reserve changes to the LVR rules, announced in December, created a period of intense growth as investors tried to beat the March 1 deadline.

"While it's too early to call an end to the property market's remarkable hot-run post-Covid, the changes suggest the brakes are now on and price growth will be at much slower rate in the months ahead.

"And the Government's housing market shake-up, particularly the new rules governing investment properties, may well result in further price drops."