An Otago academic says that is bad news for lower-income households.

Yesterday, Stats NZ released its consumer price index (CPI) for the three months to March, which rose 1.8%.

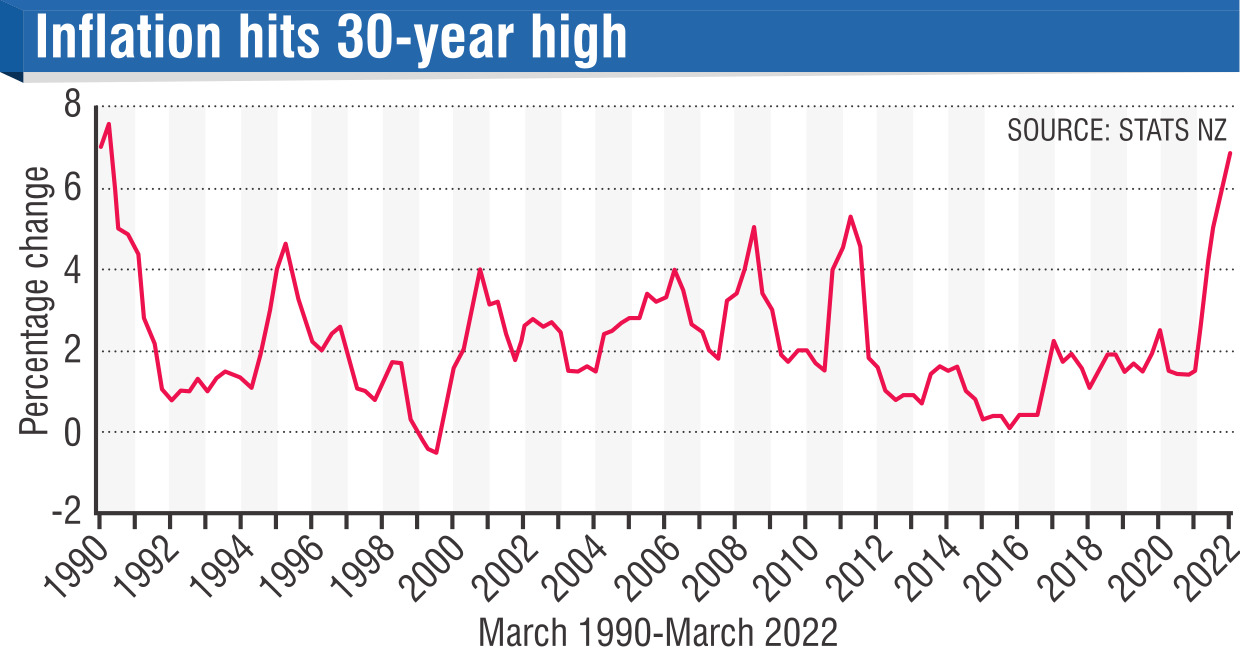

That brought the annual inflation rate to 6.9%.

While it was lower than what some economists had feared, having forecasted inflation of up to 7.4%, it was the highest rate since the June quarter of 1990 when inflation hit 7.6%.

That was shortly before the Reserve Bank of New Zealand Act 1989 came into effect to target high inflation left over from the 1980s and maintain stability in the general level of prices over the medium term.

The two main drivers of last quarter’s inflation were rising housing construction costs and rising rents.

Prices for the construction of new dwellings were up 18% in the March 2022 quarter compared with the same period a year earlier, in the largest increase since records began in 1985.

Stats NZ senior prices manager Aaron Beck said construction firms had been experiencing many supply-chain issues, as well as higher labour costs and higher demand.

The next largest contributor to inflation was motoring, particularly through higher prices for petrol and second-hand cars.

Petrol prices increased by 32% in the year to the March 2022 quarter, the largest increase since 1985.

University of Otago economics department lecturer Prof Stephen Knowles said lower-income households would be the worst hit by the current inflationary wave.

That was because a bigger proportion of their income was spent on necessary goods, such as fuel and food.

Lower-income households simply did not have the financial reserves to fall back on, Prof Knowles said.

"Inflation is bad news for most people, but it is especially bad news for those on lower incomes," he said.

Yesterday’s inflation rate made it inevitable interest rates would have to go up to get price increases under control, Prof Knowles said.

Forsyth Barr broker Damian Foster said yesterday’s figure was slightly below the 7% the market had been expecting.

That meant there was a modest reaction to the announcement on the equity markets, the NZX50 closing down 0.1%.

Mr Foster believed the market expected the rest of the year to be occupied by high inflation and increasing interest rates.

Westpac senior economist Satish Ranchhod said price pressures were "bubbling over" in every corner of the economy.

That was due to rising global and domestic costs of production, including increasing labour costs.

"At the same time, demand has been running hot in parts of the domestic economy."

The combination of those pressures had resulted in strong and widespread price increases across the New Zealand economy.

Westpac expected strength in underlying pricing pressures would continue through the course of this year and much of next year, Mr Ranchhod said.

While the inflation rate was a "touch softer" than expected, it still supported the bank’s expectation for a 50-basis-point hike in the official cash rate next month, followed by 25-basis-point increases through the rest of the year.