Water services and capital spending by council companies are the big drivers behind projected group debt for the Dunedin City Council expanding by hundreds of millions of dollars in the next decade.

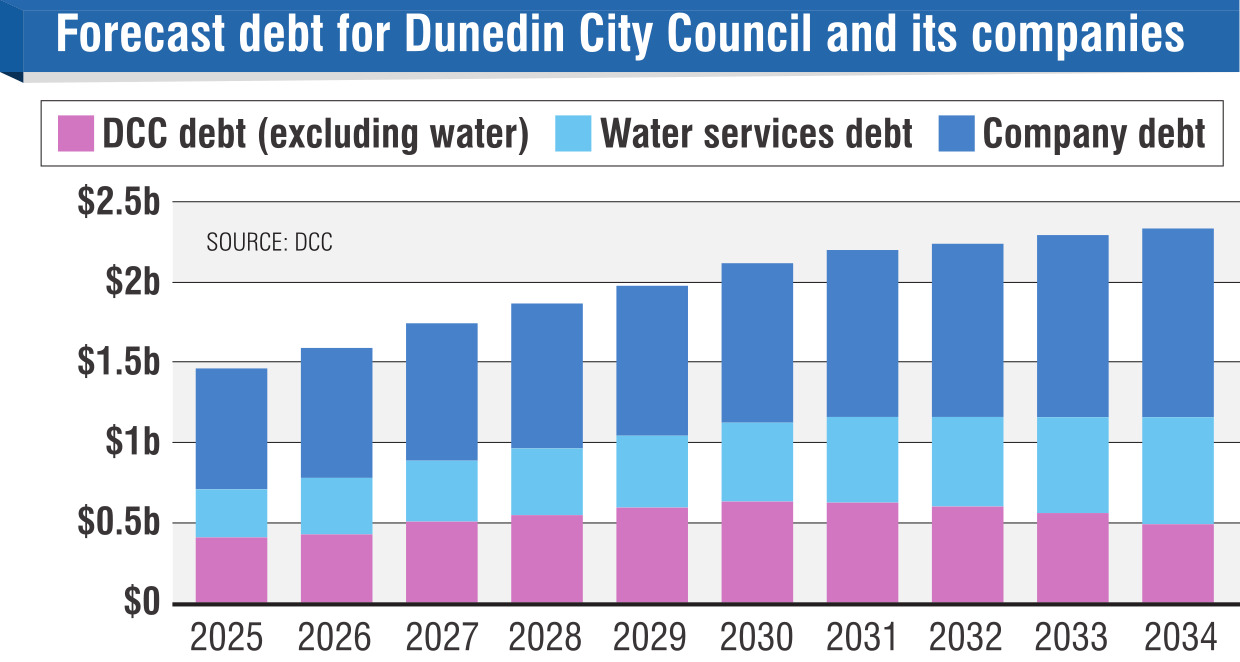

Debt for the council and its companies is forecast to increase from $1.4 billion this year to $2.3b in 2034.

Information for the council’s audit and risk subcommittee shows water services debt is set to become an increasingly large component of the council’s debt — rising from $263 million this year to more than $623m in 2034.

The other big driver of projected rising group debt is Aurora Energy, the council’s biggest trading company, which is set to carry out a capital programme hovering above $100m a year for much of the next decade.

Cr Sophie Barker described water and electricity lines networks as capital-hungry inter-generational debt drivers.

The debt profile for the council and its companies was "most enlightening", she said.

Cr Barker highlighted forecasting was helpful, but some data could be overtaken by events.

The council forecast its capital spending in the 2024-25 financial year — not including council companies — would exceed $206m, but it ended up about $148m, which was 71.5% of the budget.

Dunedin City Council (DCC) chief executive Sandy Graham said in February the council had slowed some of its procurement and she referred to "increased scrutiny and oversight" from councillors.

Dunedin Mayor Jules Radich seemed to take heart from the council falling behind on its capital programme.

The "reduction" in capital spending "bodes well for the future", suggesting the council might yet be able to start repaying debt towards the end of the 2025-34 long-term plan period, he said.

However, for this to happen, the next council would have to axe some planned spending.

It budgeted $2b of capital expenditure over the next nine years.

Cr Lee Vandervis noted this included zero-carbon projects, which he described as future "maybe sustainability" territory.

This was being "bought at the enormous expense of real and immediate DCC financial sustainability".

The council had budgeted for its debt, not including company debt, to be almost $710m at the end of June this year, but it landed on $657m after the 2024-25 capital under-spend.

It had budgeted for a $28.5m deficit for 2024-25, but posted a deficit of about $11.5m.

Deputy mayor Cherry Lucas said at a meeting last week the reduced deficit was primarily due to a decrease in estimated depreciation costs after revaluation of Three Waters assets, as well as interest costs being lower than budgeted, partly because of lower-than-planned debt.

About $1b of capital spend across nine years was allocated to Three Waters in the 2025-34 long-term plan.

This was partly because of an ageing asset base and also to allow for urban growth and meeting regulatory responsibilities.

Aurora Energy outlined in an asset management plan released in March it was facing significant growth pressure in the Upper Clutha and Queenstown areas.

"The capital investments for Upper Clutha are substantial, reflecting future growth," the company said.

"Both regions need long-term solutions."

Growth in electricity demand was also expected because of increased electrification, as more consumers moved to renewable energy sources, Aurora said.