A candidates meeting at a seaside settlement began with what the host himself described as "a little rant".

It was about rates increases.

"It’s not on, is it? It’s not on at all."

Mr Weggery told the well-attended public meeting at the Brighton Rugby Club he believed the campaign for this year’s Dunedin City Council elections would be about rates, affordability and financial discipline.

The council itself highlighted the subject in a pre-election report.

"We continue to grapple with the impacts of an uncertain economic climate, which is driving up costs and increasing budget pressures, resulting in rates rises that are higher than anyone wants," chief executive Sandy Graham said.

"Quite simply, it is an extremely challenging time.

"There is no magic wand to deliver everything our community wants and needs, and council’s role is to strike the difficult balance between continuing to invest where it’s needed and finding ways to control costs where possible."

A rates increase of 10.7% was approved for 2025-26 and this followed increases of 17.5%, 6.6%, 6.5% and 9.8%. Increases of 10.9% have been indicated for 2026-27 and 2027-28 in the council’s 2025-34 long-term plan.

The council’s planned capital expenditure programme over the next nine years is worth about $2b. More than half is for Three Waters — drinking water, wastewater and stormwater infrastructure — and a quarter is for roading and footpaths.

In general, the council has had to deal with rising costs while also grappling with ageing networks.

Council budgeting is essentially a collaboration between staff and the mayor and councillors. However, the buck stops with the city’s elected representatives. They provide oversight, make strategic calls and they are responsible for adopting annual plans and long-term plans — the budget documents — and they set the rates.

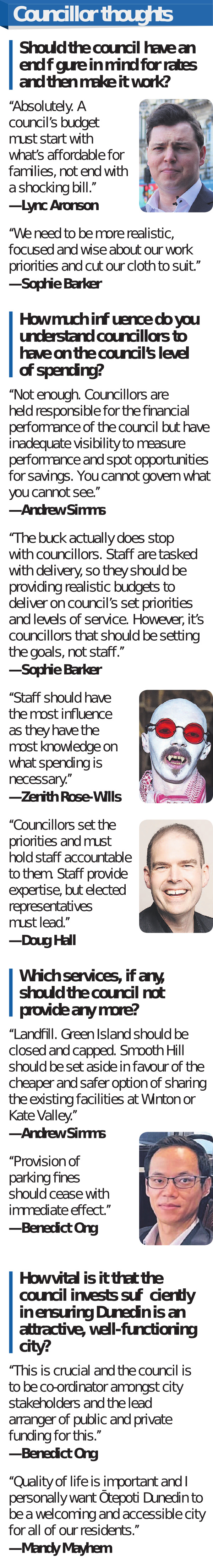

The Otago Daily Times asked Dunedin’s mayoralty candidates for their perspectives about council spending, rates and debt.

Sophie Barker said the council’s main job was to provide well-planned infrastructure and services for ratepayers, residents and visitors.

A laser focus on financial discipline was required, as well as starting a debt repayment programme, she said.

"I’ve been extremely unhappy about the last two years of rates rises of over 10% and think we should have looked harder at our work priorities, levels of service and cost centres, so the rates increases weren’t such a horrible shock in a time of cost-of-living crisis," Cr Barker said.

However, it was vital for the council to invest soundly or risk "a death spiral" of failing infrastructure and people leaving for more attractive places, she said.

"Council spending creates the city we live in and whether it works well for us, or not."

Dunedin Mayor Jules Radich, who is seeking re-election, said he wished the council had supported repayment of debt by the tail end of the 2025-34 long-term plan, rather than a flattening of debt growth.

"I retain that ambition," he said.

Dunedin had top spot among eight New Zealand cities in a quality-of-life survey and it now had to sort out a "deficit" in economic development, he said.

Mr Radich also said council costs were often driven by government imperatives.

Lee Vandervis said the council led by Mr Radich had been even less sustainable regarding debt than the "spend-up council" of previous mayor Aaron Hawkins.

Debt was set to be above $1b for most years in the 2025-34 long-term plan, costing $1m a week in interest, he said.

"These massive interest costs, as well as poor-value spending, have driven unsustainable rates and debt increases, causing many Dunedin people real hardship, especially those on fixed incomes," Cr Vandervis said.

Andrew Simms said rates rises should be held at 5%.

Comparisons were often made to the consumer price index for inflation, but the CPI was not entirely relevant, as cost drivers for council activities had generally increased more, he said.

Priorities had to be meeting community expectations for essential services such as Three Waters, transport, parks, pools and libraries, he said.

Debt should never be used for operating expenses, he said.

"In this fiscal environment, essential capital projects only, where there is no other option, should be pursued."

Mr Simms said it was essential for the council to invest in growth and economic development.

Carmen Houlahan said council spending had to stay focused and disciplined, keeping rates sustainable while still investing in the services and infrastructure Dunedin needed.

Seesaw-gate was a reference to the controversial George St playground often cited — including by Cr Vandervis — as an example of undisciplined council spending.

Mandy Mayhem said the council had inherited under-investment by previous governors of the city.

"We have requirements we need to meet and a lot of infrastructure that will soon be non-compliant without upgrades," she said.

"A vibrant and well-maintained city attracts people and investment," Cr Mayhem said.

Lianna MacFarlane said lack of a debt repayment plan was unacceptable. She would like to see a rates cap, pending an urgent review of the council’s finances.

"With the correct governance, getting income and expenses under control and responsible debt management, I would hope in the future to see rates increases in line with inflation."

David Milne said must-haves had to be delivered excellently and debt reduction should be a priority. Hard-earned ratepayer money should be treated with respect, he said.

Doug Hall said any rates increase above the rate of inflation should make the council reassess. Debt should be used cautiously and only where it created lasting value for future generations, he said.

Benedict Ong said the city needed economic growth and the council could not allow the tail (debt) to wag the dog (spending needs).

Lync Aronson said the city was on a collision course with a debt crisis. He advocated for a 40% sale of Aurora Energy to create an investment fund and he wanted a one-off capital spend on proven artificial intelligence technology to produce ongoing operational savings.

Pamela Taylor said she wanted 200 staff to be laid off and if councillors were keen on pet projects, they could fund them from their own bank accounts or local fundraising.

"We cannot afford to make cycleways endlessly ... or to remove carparks."

Zenith Rose-Wills said the climate crisis and renting crisis demanded action, which might require spending and increased rates.

"Projects that decrease the cost of living for citizens should be prioritised to lessen the impact of increased rates," he said.

"We should not be fretting about debt when people are sleeping in the streets."

Green Party candidate Mickey Treadwell said the city needed to prioritise its most vulnerable people.

"The less people struggle to meet their basic needs, the more capacity they have to contribute to their community," he said.

Investing sufficiently to ensure Dunedin was an attractive, well-functioning city should be a fundamental goal of the council, he said.

"A vibrant, functioning city is a place where more people want to live, work, and raise their families," Mr Treadwell said.

"Additionally, when people care about their city, they become more involved in it, and contribute more to our culture and community groups.

"These are not just ‘nice-to-haves’ — these are major contributing factors in the economic health of the city."

■Marie Laufiso and Flynn Nisbett did not provide responses by deadline.