Say you own a durable asset — probably a house — worth $1 million.

Someone comes along and offers you $350,000 for it — 35% of the value. Unless you are truly desperate for cash, you will of course decline this offer, politely or otherwise.

Fair enough. But let’s crank up the numbers. Suppose now you have a share in an asset worth $3.5 billion, and an offer of just over $1.2b comes in — another 35%.

Should you vote to accept this offer? Surely not — it’s the same crummy deal writ large. And if you aren’t actually given a chance to vote on the matter you will be very cross and make a fuss.

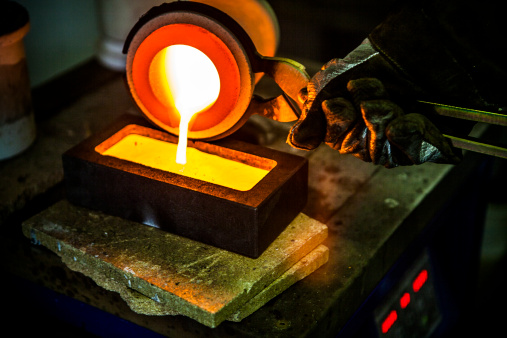

Well, the actual asset at stake here is the gold projected to be under the surface of a quite large expanse of Central Otago by an Australian mining company called Santana. What its sponsors are calling the Bendigo-Ophir Gold Project would, over many years, yield an expected $6b of marketable gold, generating profits after mining costs of around $3.5b.

The company would have to pay the farmers who own the land agreed fees for coming on to it and messing it up, but not for actually mining the gold because, in New Zealand, all subterranean gold (or silver, or uranium, or oil and gas) is owned by the Crown — that is, by us the citizens.

The Crown charges quite meagre royalties on our gold when it is mined: at a rate of either 2% on gross sales value, or 10% on profits — whichever is greater.

In this case, with the Bendigo mine’s lavish profit margin, the 10% figure would probably apply: so, around $350m.

Then the remainder should be subject to New Zealand standard corporate taxation at 28% — another $880m, giving a total take of $1.23b.

So, that is more than a billion dollars which our government would otherwise have to extract from us all in income tax or other taxes, and can as such reasonably be put on to the benefit side of the ledger in any social cost-benefit analysis of the mining project. Of course, the actual number could turn out to be larger or smaller depending on how the price of gold pans out in the next decade or two.

But the point is this: it is hugely less than the value of our gold.

In their prospectus and press releases, Santana try to pile on another half billion of purported benefits — these being the wages and salaries to be earned by their employees digging and operating the gold mine.

Here they are on shaky ground. Wages are a cost, not a benefit. The new jobs have to be filled by bidding workers away from their existing jobs.

Only if the region has high unemployment will a significant fraction of the jobs go to previously unemployed workers. The current unemployment rate in booming Otago is 2.8% — well below the national figure of 5.3%. And, jobs filled by people migrating into the Upper Clutha region will increase prices in an already expensive housing market.

In objectively analysing the costs and benefits, we do need to distinguish the gold mine from the sort of project proposals that more commonly come up for consideration.

So, suppose Taylor Swift offered $1m — please — to rent Dunedin’s Forsyth Barr Stadium for a one-off concert. Take it, or leave it and she goes elsewhere.

Of course Dunedin would accept the offer, even if Swift herself would clear millions more in profits from the event. She deserves it, and $1m is a heck of a lot better than nothing.

But for the proposed gold mine the alternative is not nothing. It is that we keep our gold and we keep our precious Central Otago landscape, and we keep the tourist business that would be deterred by the mine and its ugly workings.

As a Dunedin boy, Wānaka homeowner and life-long lover of Central, I fully understand why so many people are very cross about the Bendigo-Ophir Gold Project, and I am glad they are making a big fuss about it, and about us having no say in the matter.

But even as a simple economist I believe it prudent to keep our powder dry on this one.

I expect the gold will be mined eventually — perhaps if gold prices really soar, or if less invasive mining techniques are developed, or if climate change collapses our tourism industry.

But not now. Let the land lie in peace awhile.

• Sometime Wānaka resident Tim Hazledine is an emeritus professor of economics, University of Auckland.