You are not alone.

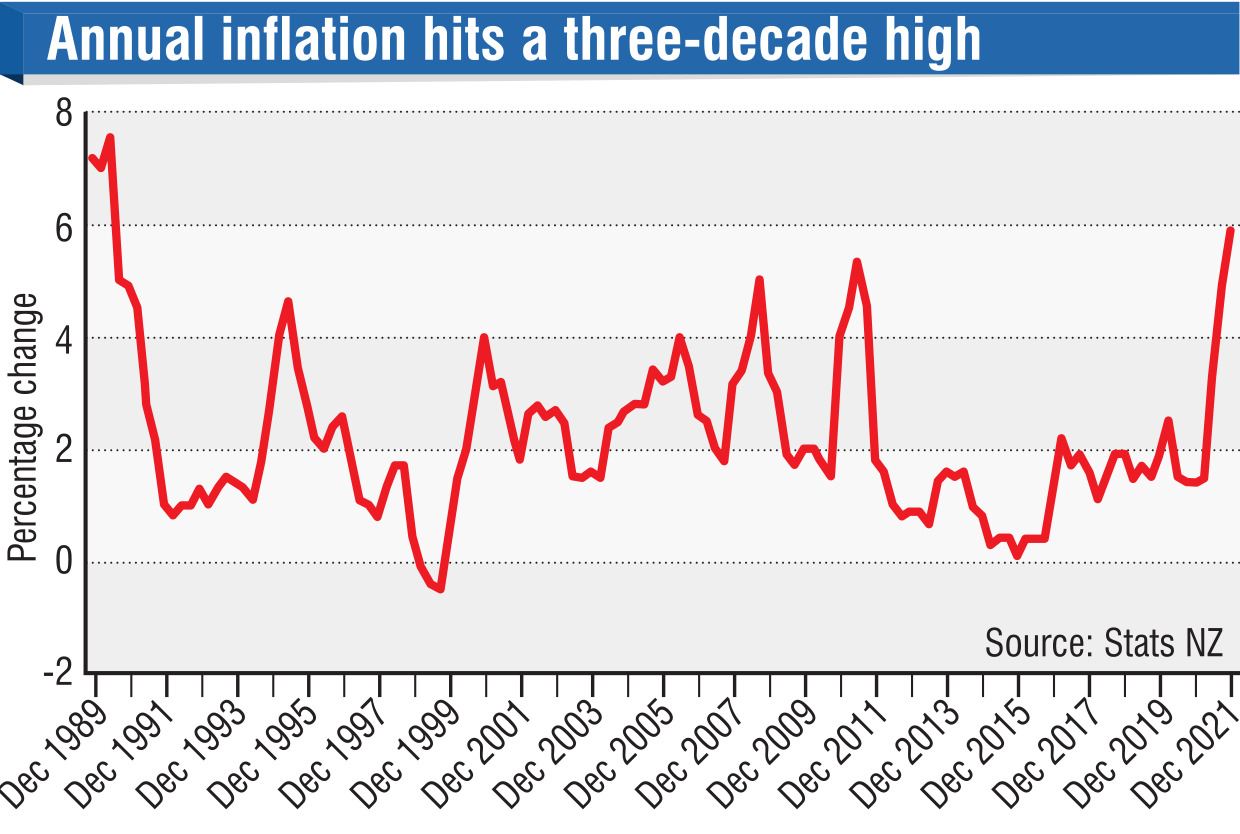

New Zealand’s annual inflation rate — the economic term that refers to an environment of rising prices of goods and services within an economy — has increased by 5.9%, the biggest increase in 30 years.

Yesterday, Stats NZ released its consumer price index (CPI) for the three months to December 2021, which rose 1.4%.

Ten of the 11 groups used by Stats NZ to measure the CPI rose over the quarter.

The strongest lift was in housing-related costs, such as building new houses, rents, rates and utility prices.

The price for building a house increased by 16% and rental housing increased by 3.8%.

Petrol prices increased by 30% in the year to December 2021.

The average price of 91 octane petrol was $2.45/litre last quarter, compared to $1.87/litre in the December 2020 quarter.

Those were partly offset by slightly cheaper food, down 0.7 %, and also alcoholic beverages and tobacco, down 0.3%.

The inflation rate announced yesterday was the biggest since the June 1990 quarter, when it hit 7.6%.

University of Otago department of economics senior lecturer Dr Murat Ungor was not surprised by yesterday’s high inflation rate.

Inflation was already high following on from the last quarter and there was nothing in place to stop that.

It reaffirmed the need for the Reserve Bank to keeping lifting the official cash rate throughout the year.

Dr Ungor expected to see it lifted to 2% by August in order to combat the inflation.

Yesterday’s rate was not the peak, just yet, he said.

He expected it to reach 6.5% later this year, before it started to drop early next year as the impact of a higher OCR took effect.

"I don’t think it is over just yet," he said.

The risk with historically high inflation rates, such as this one, was that it created more disparity for those on lower incomes.

Dr Ungor believed politicians and policymakers needed to look at targeted support for those people.

"That has the potential to be quite damaging for some people."

ASB senior economist Mark Smith said the data showed there was a solid core of domestically based inflation and that it was not just a temporary matter.

"A broadening front of rising inflation is emerging that will be difficult to slow, and we expect annual CPI inflation to remain above 3% well into 2023," Mr Smith said.

The strength of the numbers was expected to drive a series of official cash rate rate rises this year.

"Persistently high inflation and an extraordinary tight labour market backdrop and outlook warrants a faster pace of OCR hikes and a higher OCR endpoint," Mr Smith said.

He also expected the cash rate to reach 2% by the end of the year.

Prime Minister Jacinda Ardern said the rate of inflation was very much predicated on the global situation, and in the US, for example, the rate was even higher than in New Zealand.

Oil prices and international tensions that affect those oil prices were a contributing factor, she said. — Additional reporting RNZ