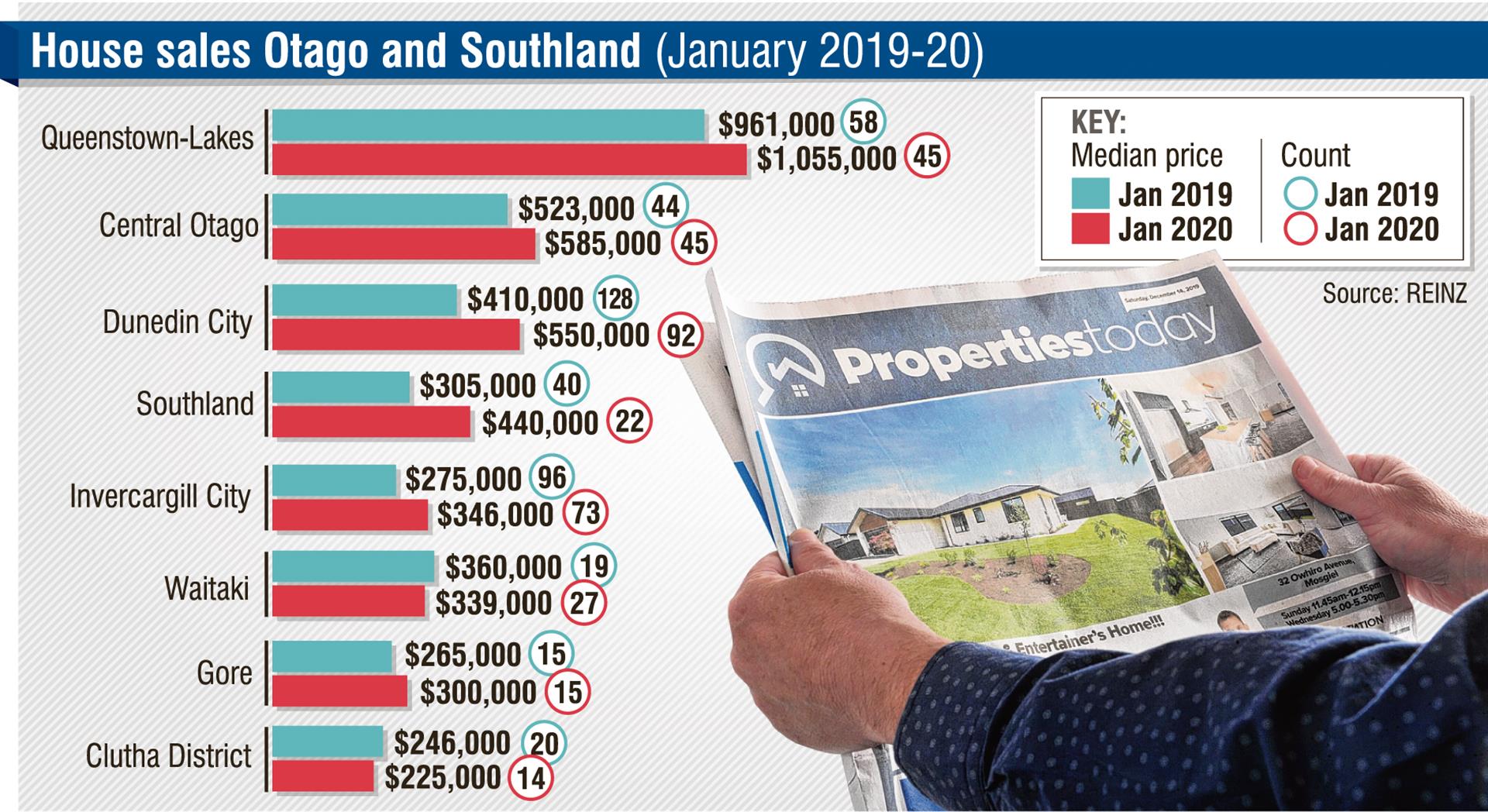

The average price of a home, however, rose to a record $550,000.

Latest Real Estate Institute of New Zealand numbers showed a significant tail-off in year-on-year sales, which dropped by more than 28% to 92 across the city for the month.

A year ago, 128 homes changed hands in January, at an average price of $410,000.

Property agents say February is looking more robust, however, and several expect a jump in listings, which they say could translate to more realistic pricing.

NIDD Realty owner Joe Nidd said 238 houses were listed in the city at present, an improvement on recent months, and a ‘‘considerable’’ amount of new listings were expected to come to the market in the coming weeks.

‘‘Some good news is that the Dunedin City Council have found resolution on one of the main objections holding up the Second Generation Plan, which will hopefully ... help re-zone land for development in and around the city.’’

Institute chief executive Bindi Norwell said while January had been a quiet time for some regions, it had been a strong start to the year with the most properties sold over the past four years.

‘‘Ten out of 16 regions saw annual increases in the number of properties listed, with strong uplifts in sales volumes.’’

She said the increases were being driven by increasing confidence in the housing market underpinned by a relatively strong economy, good employment rates and the continuing low-interest-rate environment.

Overall sales were up by 3.2% over January.

Westpac chief economist Dominick Stephens said he expected the current upturn to be at around 10% by the middle of this year.

‘‘We predict that the pace of house-price inflation will soon start easing off as rising fixed mortgage rates gradually crimp the market.’’

He said the market’s behaviour over the past year showed how financial factors could trump physical supply and demand.

Kiwibank senior economist Jeremy Couchman said the bank did not expect the acceleration in house prices would last long.

‘‘New desperately needed supply is coming on line at the same time population growth is slowing. Residential consents have hit levels well above the high hit back in 2004. Over 2019, 37,500 residential dwellings were consented, mostly in Auckland, where they are needed.

Mr Couchman said net migration was easing and was estimated to have reached close to 44,000 people in 2019 — down about 20,000 people from the peak recorded in 2016.

‘‘New Zealand still faces the issue of housing affordability that is now not just isolated to the larger centres.’’

Meanwhile, Stats NZ reports that CPI rental prices climbed by an average 5.5% from last January through the lower South Island.

Harcourts Property Management Dunedin manager Sarah Warhurst said while market conditions had eased from the January peak, the shortage of stock remained challenging, as did the increase in rents and rental expectations.

‘‘Rental costs have increased and will continue to increase due to the pending healthy homes regulations.’’

Despite the rent increases, Stats NZ income and poverty statistics manager Chris Pooch said that, on average, households were paying no more than they were in 2018.

He said that for the year to June 2019, households spent, on average, $17,227 on housing costs.

Stats NZ regional numbers show that of average household gross income of $87,057 in Otago and $85,233 in Southland, disposable income after housing costs remained at $33,189 and $35,089 respectively.

By comparison, the average Canterbury household earned $104,644 with $38,166 in disposable income after housing costs.

Comments

At the average rather than the median house price, $550,000 is absolute insanity. You could move to Queensland and live in a mansion for that

And so falls by the wayside those on low pay and those struggling to make ends meet to be able to buy their own home, renters for life now.