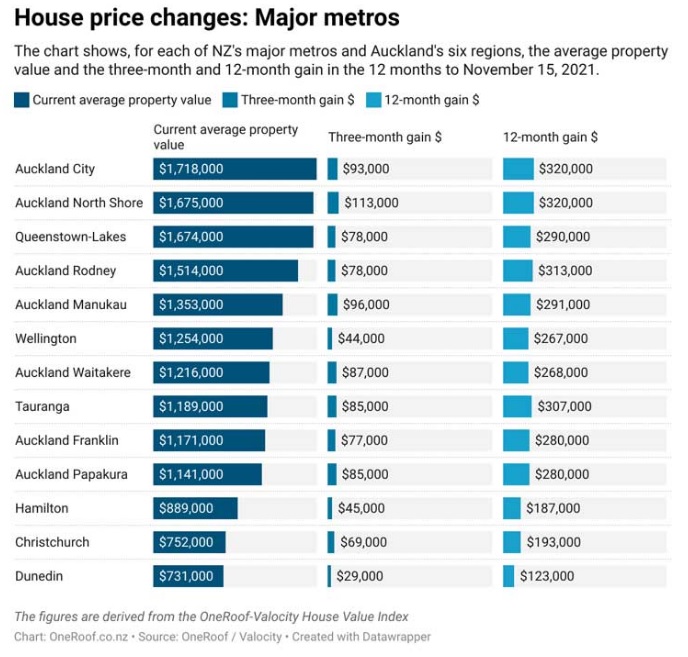

Dunedin’s average property value has grown just 20% ($123,000) over the last 12 months to $731,000 – well below the nationwide growth figure of 27% ($225,000).

Price growth slowed to just over 4% ($29,000) in the last three months, and saw Dunedin being overtaken by Christchurch, where the average property grew 10.1% ($69,000) over the same period to $752,000.

Dunedin’s less-than-stellar run post-Covid is a far cry from the strong price growth it enjoyed in the year before the pandemic struck New Zealand.

Joe Nidd, owner of Nidd Realty in the city, says the housing market has settled back into “slightly more rational levels” after a period of rapid growth.

That’s partly because new stock has come to market, giving buyers a bit more choice – the flipside of that is banks have tightened up on lending.

“We’re having strong multiple-offer situations but less of those are resulting in unconditional offers – we’re seeing more of them still ending up with a few more days to find finance out the other end,” Nidd said.

While that has changed a bit, with stock now getting into the 350 range of listings for the city – enough to give people choice – listings are still low.

When there are only 150 sales some months there is room for error when looking at price increases, says Nidd, who is cautious to pick any kind of trend.

“We see it jump by five percent or more sometimes and people get all excited and start to predict where things are going. Then two months later they’re completely wrong,” he says.

“We’re still close to the all-time high and hovering around there.”

Many people have moved to Dunedin for cheaper housing, fuelling house-price growth in recent times, and there is also demand from those building new infrastructure in the southern city.

Pressure has been relieved slightly, however, with less investor hunger, combined with more new builds coming online.

“Possibly what we are seeing, in a slight pullback in the month-to-month numbers, is that people have a little more choice. They can take a bit more time, and if they miss one, they don't have to put in extraordinary offers just to secure this one because it's the last one. There will be more choices in the following month.”

Changes to Dunedin’s district plan have opened up infill housing, with increasing density across the suburbs.

Greenfield developments, too, are also under way on sites where schools may have been closed and which are now becoming medium- to high-density homes.

“It's a combination of both marginal land becoming quite viable because of the market increases and zoning, allowing for higher density and more profitable arrangements.

“There was one sort of semi-rural site which spanned two suburbs in the Corstorphine area which had been left for a really long time. Suddenly that’s gone on everyone’s radar because what was seen as marginal land is now seen as a bit of a goldmine because of the number of sections you can get on there.”

A lot of people with large, semi-rural properties are benefiting from the rezoning, too.

“They've had a mid-sized lifestyle block, say, and they've then had that five to 10 section range.”

A greenfield subdivision at 25 Camp St, Broad Bay, has sections selling for around $500,000, he says.

“That was an area that was deemed a long way out of town. You have to go down to the Bay. Five years ago it probably would have been quite a hard sell but now there are people lining up.”

Nidd doesn’t expect demand to fade any time soon but says if interest rates increase significantly the first and second home market may struggle further with finance.

“Overall, I still believe the supply side is the key to this whole situation. Even with the increase in supply we're seeing down here, it appears to only just be keeping up with the increase in demand.”

- OneRoof

Comments

"Less than stellar run"

The whole premise in the tone of this article is that growth is good and the more the better. This must change.

20% is far too much to keep housing affordable, whether for renters of buyers. This entre article could, and should, have been written with Dunedin topping the chart for the most stable of housing markets in the country, but more needs to be done.

It is exactly this type of messaging that keeps the government from acting far more decisively to keep housing affordable because it misleads voters into thinking growth is good.

New Zealand doesn't have a housing supply problem, New Zealand has a housing greed problem, where what should be a market for putting a roof over people's heads has become a cruel, inequality causing investment market, very much at the expense of putting a roof over people's heads.

Shame on you for printing such greed bait.

Goodness me! Regardless, house prices in Dunedin were 'skyrocketing' even before covid. You just have to look at historical sale prices from only as far back in 2016 to see that they have near trebled since then. And once the new RV's come out, they will rise again..

House price 'growth' is a bad thing for most people, except for a few investors.

We should be proud to be low on this list.

Responsible journalism would consider ways to limit this 'growth' not fuel it.