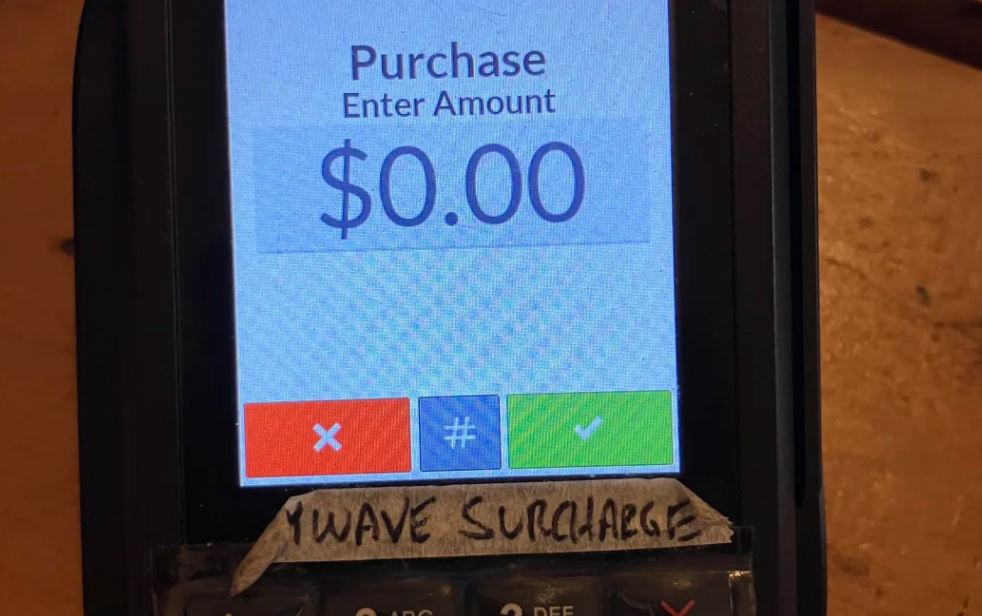

In the grand scheme of things, in-shop card surcharges seem trivial, usually only a percentage point or two.

Yet Consumer NZ points out these charges can add up to $300 or $400 annually. Invested over decades, this could compound into many thousands.

But the issue may be reopened. Act New Zealand’s backing for the necessary legislation is uncertain, and retail groups are lobbying to keep at least reduced surcharges.

Civis considered surcharges earlier in the year, offering cautious support for the ban. National and Consumer NZ both strongly favour prohibition; Consumer, which has advocated for this since 2017, has even labelled the situation a "national embarrassment".

Civis acknowledges the pressures on small retailers, for whom even half a percentage point can meaningfully affect margins, but overall, the sector’s record on surcharges has been disappointing.

Many retailers did not reduce their surcharges after the 2022 interchange fee cut, a change that saved the industry an estimated $150million. Likewise, many have been slow to reflect the latest reduction from December 1.

Interchange fees now sit at 0.3% for credit cards and about 2% for debit cards. Though low by international standards, they remain high enough to support innovation in the payments sector.

Retailers have frequently applied a blanket surcharge to both credit and debit cards. But debit cards should have been cheaper, even cost-free when inserted or swiped.

Retailers are meant to offer a no-surcharge option, eftpos or cash. But Civis has been charged a surcharge when using eftpos.

The entire system became confusing and inconsistent.

Cash, meanwhile, carries handling costs and security risks — no surprise its use continues to fall.

As Commerce and Consumer Affairs Minister Scott Simpson notes, the price on the shelf should simply be the price paid at the checkout.

Retail NZ’s member survey shows support for keeping surcharges. Chief executive Carolyn Young has proposed a "compromise": capping debit surcharges at 0.5% and credit surcharges at 1%.

This approach ensures that costs, though significantly reduced, are not spread across all customers. Those using the slightly less convenient eftpos option can stretch their dollars further, rather than subsidising other shoppers.

The planned ban would cover Mastercard and Visa, though some foreign-owned credit cards would be exempt. At the same time, reward schemes are shrinking as transaction margins tighten.

It’s time those little stickers on payment terminals disappeared. We shouldn’t be penalised for the simple act of paying.

The now relatively small charges are part of the cost of doing business, just like rates, insurance or electricity.

Next, the government should set its sights on online merchant and ticket agency surcharges. These are frequently excessive, often worse than those faced by in-shop shoppers.

* * *

Everyone has phrases that grate. Civis hopes never to hear "to be honest" in 2026; it implies honesty is optional rather than expected.

This verbal abomination is a close cousin of "I’m not going to lie to you", a phrase that instantly casts doubt on everything said before. If your credibility needs a disclaimer, why should anyone believe the claim that not lying is not also a lie?

"Going forward" is another annual offender that deserves permanent retirement — along with "at this moment in time" and "at the end of the day".

Which phrases annoy you most?

By contrast, Civis has long appreciated the differing wisdom and cents in two classic proverbs. Both could be applied to surcharges.

"Look after the pennies and the pounds will look after themselves" and "penny-wise and pound-foolish".