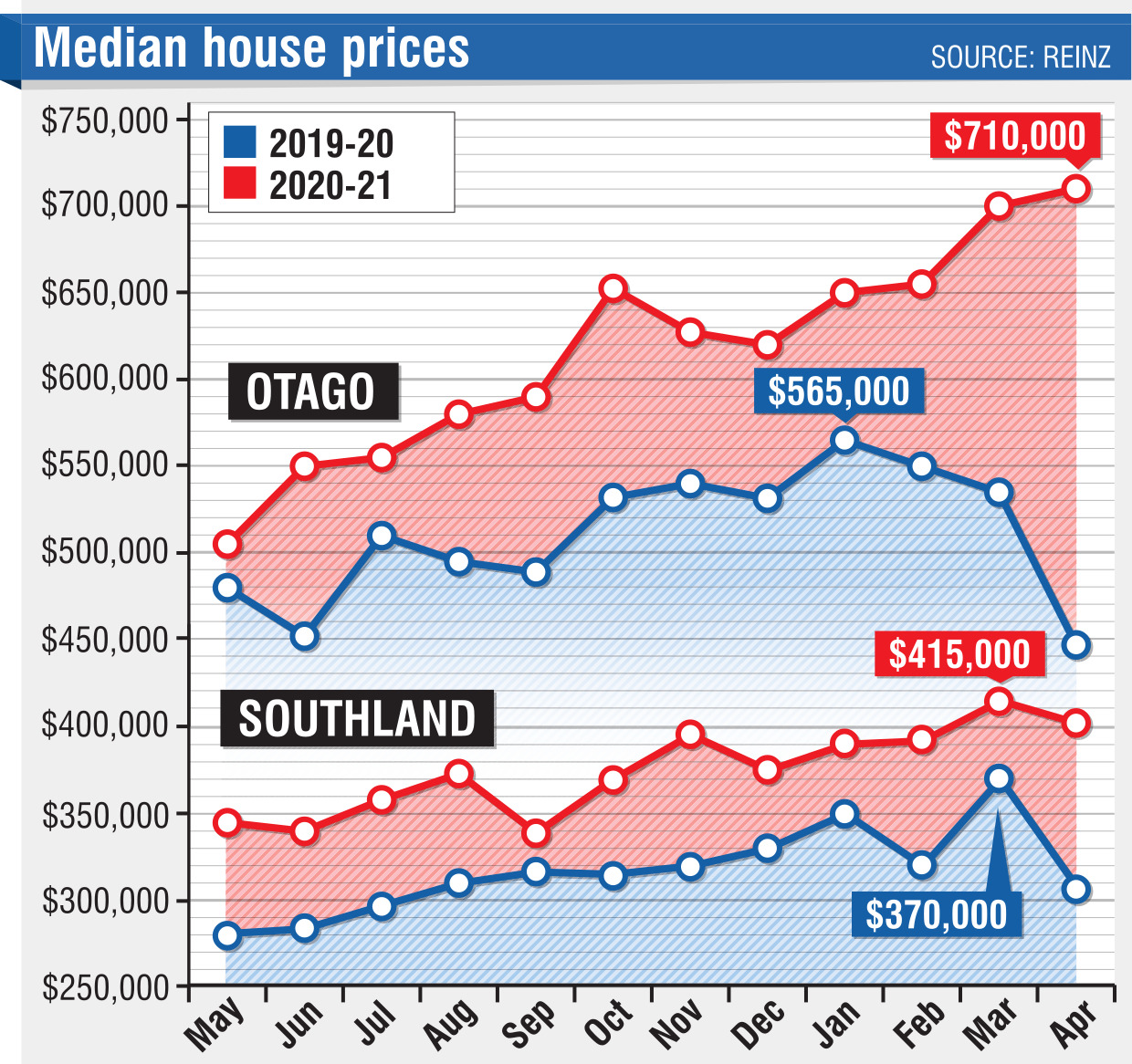

Figures released yesterday by the Real Estate Institute of New Zealand (REINZ) show both Otago and Southland had substantial rises in median prices, up 58% and 30% respectively.

Excluding April 2020, Otago had the lowest April sales volumes since April 2008.

Dunedin reached a record median house price last month of $621,120, up 25.5% from $495,000 last year, but the number of properties sold in the city decreased 37% from March this year.

Dunedin’s REINZ regional commentator, Liz Nidd, said the decrease in the number of properties sold came as investors started to pull back from the market after Government announcements.

"First-home buyers have remained active in the market, now making up a larger portion of active buyers as they try to take advantage of the investor slowdown,’’ she said.

"Access to finance has continued to be an issue for those with lower levels of equity, resulting in more cash buyers at the upper end of the scale.’’

The next few months would be telling as to the depth of the effect the Government changes, Ms Nidd said.

The lack of stock is continuing to put pressure on housing in the Queenstown Lakes district.

Median house prices in the area reached $1.2 million last month, up 42.2% from $850,000 in April 2020.

Listing and buyer inquiries in the district were down following the Government announcements, REINZ regional commentator for Queenstown Lakes Gail Hudson said.

"Partially as a result of very restrictive lending, plus there is a regular seasonal slowdown that comes with winter.

"Buyer inquiries from Australia have increased slightly since the opening of the transtasman bubble has made the option of a move or holiday house in Queenstown more viable,” she said.

In Southland, median house prices rose from $307,000 in April last year to $402,000 last month.

The number of properties sold decreased 40.2% from March 2021.

The REINZ’s acting CEO, Wendy Alexander, said that was caused by first-home buyers and investors stepping back slightly after the Government announcement in late March, to take "a wait and see’’ approach as to how it might affect them.

The REINZ House Price Index for Southland increased 19.6% annually to a record 4156, showing that the underlying value of properties in the region was still increasing, Ms Alexander said.

"Moving forward, we expect the Southland market to stabilise further,” she said.

Comments

Would it be correct to assume that part of this overinflated catastrophe that is rising house prices, is in part, and among many other contributing factors such as unsustainably low interest rates, due to the decrease in the number of properties sold in the city? And just remember, household debt is at its highest level ever, and that interest rates will not stay this low for the next 30 years, or for whatever the term of your mega loan is.

It really is a market out of control. A would-be first home buyer, based on those Dunedin numbers of 495k to 621k a year, would need to save an additional $243 per week, or $12,600 per year, on top of normal savings, just to keep up with the market, and that's for a 10% deposit, which is also a tough ask in this market!

It is good to see that sales numbers are down though, because these numbers also show that if the market dropped by 25% it would only impact on those who bought in the last year, and then not all of them.

It really is time we got our heads around the idea of the market dropping substantially over a year or two. It really needs to happen.