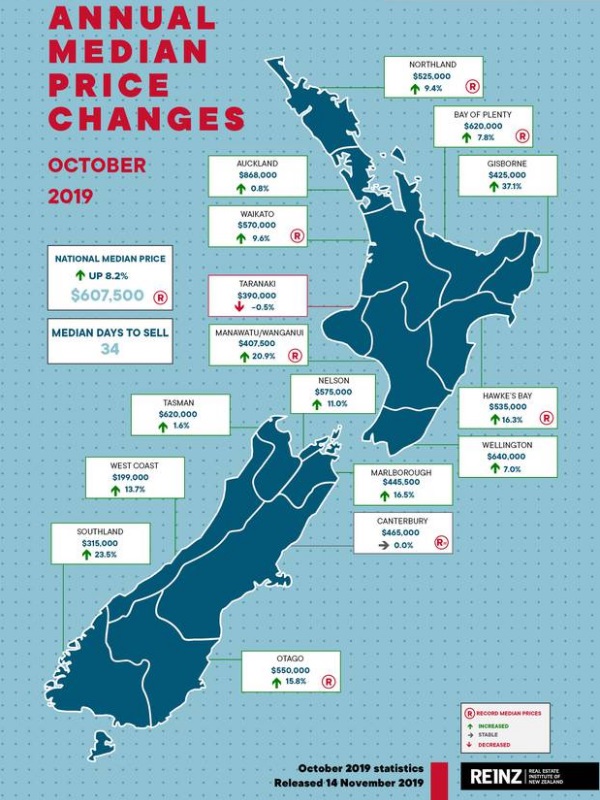

New Zealand house prices have set a new annual record, and Otago and Southland are in the top six fastest-rising areas for annual median house prices.

Latest Real Estate Institute data showed that was the first time this country's house prices had gone above $600,000.

Otago has risen to a new record annual median house price at $550,000.

Southland was the area with the second highest percentage of growth, at 23.5% just behind Gisborne, when it came to annual median house price and had a median value of $315,000.

Auckland house prices rose by a median $7000 annually, from $861,000 a year ago to $868,000 last month which REINZ said was the highest median price for that city in 19 months.

Six areas with the fastest-rising prices annually were:

- Gisborne, up 37.1% from $310,000 to $425,000

- Southland, up 23.5% from $255,000 to $315,000

- Manawatu/Whanganui, up 20.9% from $337,000 to $407,500;

- Hawke's Bay, up 16.3% from $460,000 to $535,000;

- Otago, up 15.8% from $475,000 to $550,000;

- Waikato, up 9.6% from $$520,000 to $570,000;

REINZ chief executive Bindi Norwell said October was a strong month for record median prices and the new national record median.

"This is the highest number of regional record prices we've seen for the country in 23 months."

And she noted Auckland's lift: "Auckland City saw the highest median price in 28 months with a 4.6% annual increase to $1,001,000, in part due to a 43% increase in median price in the Waitemata and Gulf area."

National sales volumes fell 4% in October compared to a year ago. Norwell said it was unfair to compare October last year with last month due to the number of people aiming to sell their home before the foreign buyer ban came into effect at the end of October 2018.

"It's not surprising that the number of properties sold fell when compared to last year. When you add this to the fact that there are around 7800 fewer listings for the first 10 months of 2019 when compared to the same time last year, it's no wonder sales volumes are down," she said.

The REINZ House Price Index, which measures the changing value of property, rose 3.9% year-on-year to 2863, a new record high.

In October the median number of days to sell a property nationally decreased by a day from 35 to 34 days when compared to October last year. This figure was down two days on last month's figure of 36 days, REINZ said.

Auctions were used in 15.5% of all national sales last month, with 1052 properties selling via that method, in line with the same time last year.

National Inventory is falling: the total number of properties available for sale nationally fell 13.1% in October to 22,313.

Last week Auckland's largest agency, Barfoot & Thompson, reported a lift in the number of new listings in October which it claimed set the scene for the Auckland residential housing market to be active.

Since March, a modest number of properties had been listed to the point where, by the start of October, numbers were at a two-year low. But the agency said it was now enjoying a 40% listing number leap on the previous three months.

New listings with that agency jumped from 1204 in September to 1605 in October.

CoreLogic said last week the house sale market showed further signs of strengthening nationally in October with all main urban areas enjoying property value lifts.

The CoreLogic QV House Price Index showed that nationwide, average property values rose by 0.4% last month.

"Housing market conditions are building momentum, following the tentative signs of growth witnessed last month," CoreLogic commentary on November 4 said.

Regionally, the standout performer from main centres remained Dunedin, up 2.7% over the month to be up 6% quarterly, the biggest jump in values in nearly 15 years.

Auckland's North Shore, previously the city's weakest value growth area, now led the region's recovery, with 1.5% growth in the three months to the end of October, CoreLogic said.

Comments

As if rising house prices are something to crow about, we still have homeless and people on waiting lists to get into homes.

Fast disappearing are those first home buyers wanting to buy their first home, they are stuck renting, paying someone else's mortgage.

In the mid 1970's house prices had risen 60% in a very short period of time, and interest rates were in the 20% range by the 1980's all driven by high immigration. My parents never could afford to buy a house, and they both worked full time. I entered the workforce in 1983, my week of pay $124 virtually equalled my rent at $115pw. I finally owned a humble 80m2 run down do upper by 1996. Interest rates were around 11%.

In 2016 house prices had risen some 60% in 4-5 years, interest rates less than 5%, again driven by high immigration. House prices could very well level out, history usually repeats. And it's no different anywhere else in the world. We can only do the best we can and maybe lower or expectations.