On Saturday, October 26, 1929, to most, all seemed well.

Readers of that morning’s Otago Daily Times were informed on page 10 that the volume of business transacted in the previous week at the Dunedin Stock Exchange had been the largest for some time, and that mining and banking shares - particularly in the Bank of New Zealand - had been especially popular.

However, most brokers likely skipped their Saturday morning lie-in that day as they were well aware of the story being carried by the ODT on p13 - "Spectacular decline; New York Stock Market; worst break in history; scenes of utmost confusion’’.

On what came to be called "Black Thursday’’ a record 12.9 million shares had been traded on Wall Street. In a selling frenzy the market lost 11% of its value once the opening bell rang and the blood-letting continued unabated for the rest of the day.

"Traders surged about the brokers’ offices watching their holdings being wiped out, such scenes ensuing thereby as have ever, if rarely, been witnessed,’’ the paper reported.

Having had the weekend to digest the news, the ODT editorialised on Monday on what it called "an extraordinary tale of financial fever, panic and excitement’’.

"Precisely what it is all about may be something of a mystery to the uninitiated,’’ the leader writer opined, the phrasing suggesting the author may have been part of those ranks.

That said, they were bang on the mark with their overall assessment of what we now know was the start of the Great Depression.,

"The result is clearly that a number of people are going to be vastly out of pocket,’’ the paper said, before going into a sniffy discourse on how Americans’ "orgies of speculation’’ may not have resulted in as prosperous a country as the United States supposed.

The same day’s paper ran an account of Saturday’s trading at the Dunedin Stock Exchange which betrayed little sense of panic: buyers were offering 4s for shares in Paddy’s Point mining but brokers would not do business at less than 5s 3d. Perhaps they were assured by the same cable report that the ODT had of banks

moving to stabilise the New York market.

However, when Wall Street reopened on Monday US time the market dropped another 12.8%, and on "Black Tuesday’’ it plunged a further 11.7%: almost a quarter of the market’s value had been shed in 48 hours.

"The worst flood of selling ... has wiped out approximately 25,000,000,000 of quoted values,’’ the story said, using figures which no doubt had the ODT’s typesetters scrambling to find more zeroes.

The following Saturday’s Dunedin Stock Exchange weekly review did not mention the turmoil overseas, although reduced volume of business and a lack of offers for several stock issues at quoted prices gave a hint of caution by local traders.

In fact, through November and into December if you read that part of the paper alone you could be forgiven for not thinking dark clouds were on the horizon ... although several references to "a complete lack of business’’ at the Exchange were a portent.

Then on December 7 the ODT reported that business that week had been "largely affected by a noticeable easement in Australian shares’’, and by the 14th "bank shares, particularly Australian banks, have been rather easier, some shares showing a substantial decline’’.

By January 25, "despite the fact that the holidays are now well past the volume of transactions has not shown any sign of reaching the level attained at the end of last year’’, and the following week only one transaction was recorded.

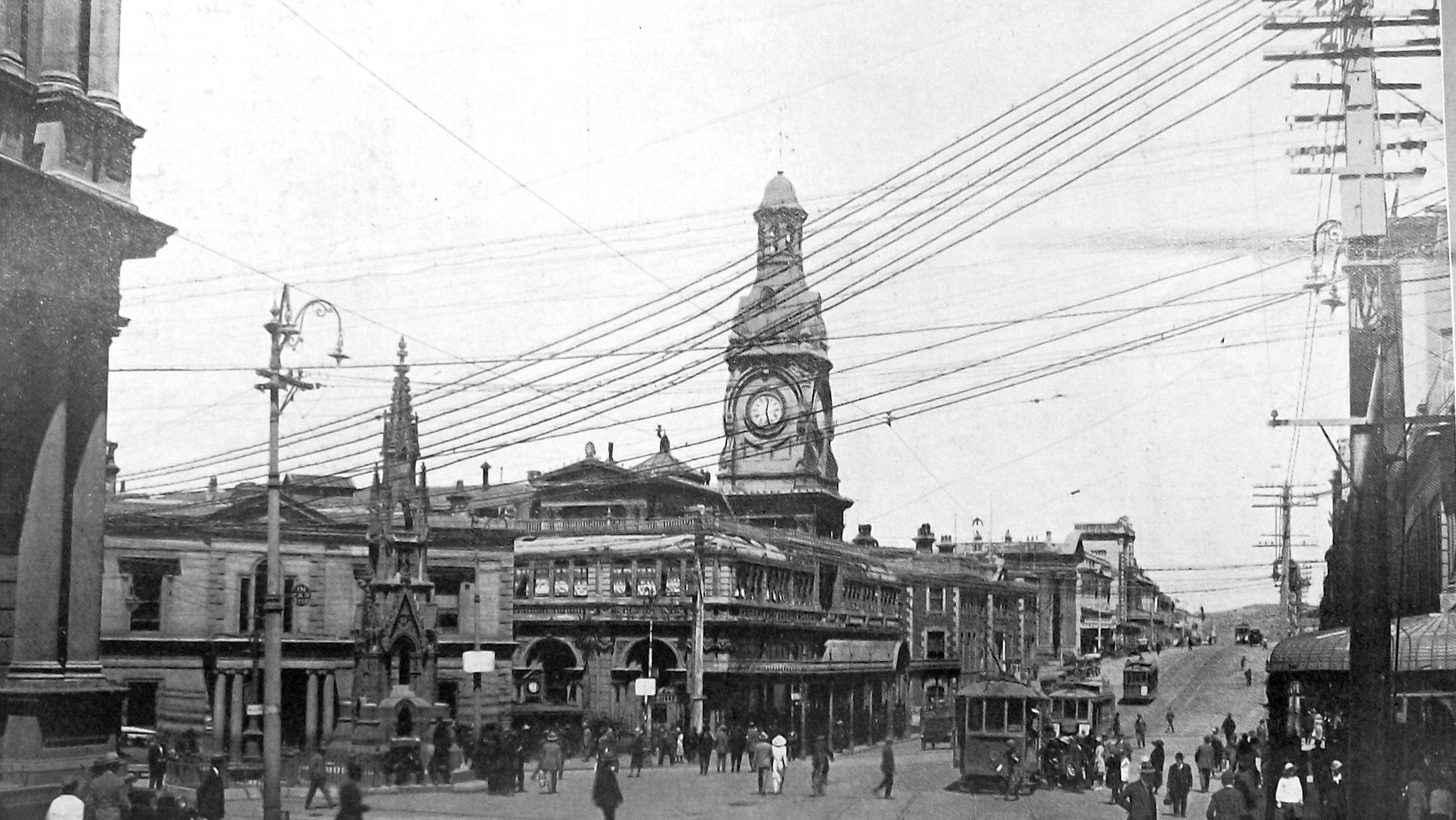

A slight bounce-back ensued but the chill of worldwide economic depression was inching toward Dunedin. In two years’ time the city would witness appalling poverty and a riot by unemployed workers.

!["They [mayors] do not have the capacity, capability or desire to do the job" — Otago regional...](https://www.odt.co.nz/sites/default/files/styles/odt_landscape_small_related_stories/public/story/2026/01/c-memorialhall-1.jpg?itok=4Go2bdgg)