CoreLogic released its Best of the Best 2021 property report yesterday and in it the research firm predicted a cooling of the market in the year ahead.

CoreLogic chief property economist Kelvin Davidson said the factors behind house price increases were changing and New Zealand could be nearing the peak of the market.

"I’m not saying the peak is absolutely now, but I think we might look back in time and say, ‘Yeah that was more or less the peak of this cycle’."

But those factors were tempered by low unemployment.

Historically, falls in house prices in New Zealand were linked to recession and rising unemployment, which were not in most forecasts.

CoreLogic had done some work around what parts of the country might be vulnerable to house prices falling and the South Island looked safe, Mr Davidson said.

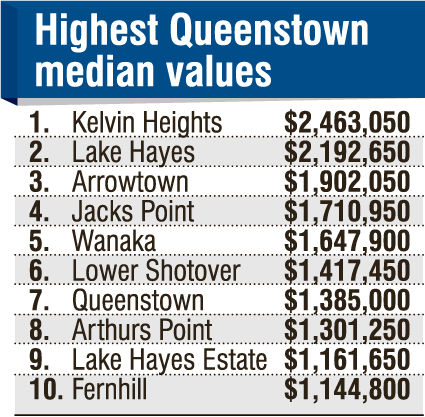

In Queenstown, from April to June this year, house prices had dropped, he said.

But the housing market price drop was short-lived. By June or July, people had recognised there were opportunities there and snapped up any properties they could and the area bounced back.

"People who bought in June or July, I suspect, are pretty happy," Mr Davidson said.

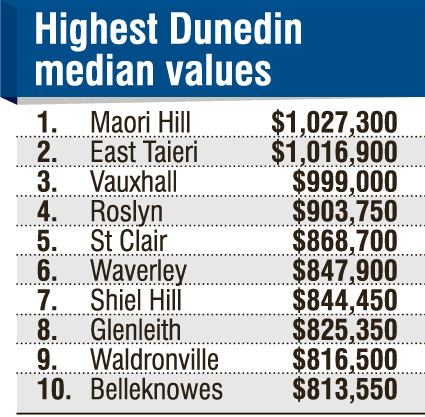

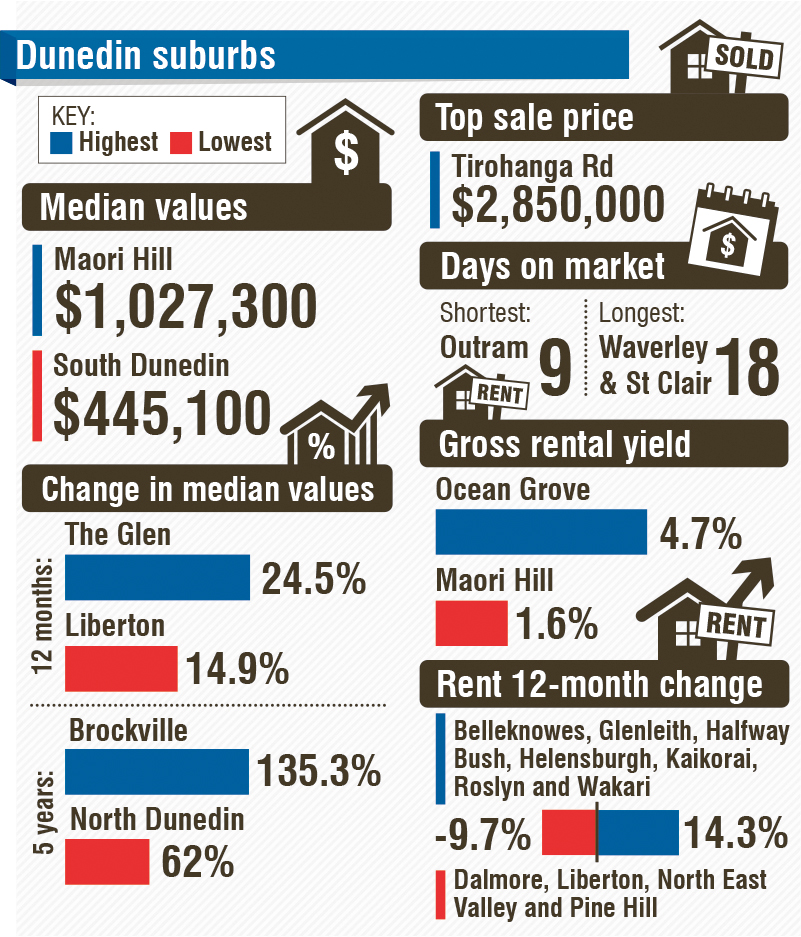

Dunedin was an area where the effects of a changing market could be felt more significantly.

"I suspect buyers in Dunedin might start seeing a bit more choice out there. That puts the power in their hands a little bit more," Mr Davidson said.

Sales volumes were down and property value growth also cooled from the middle of 2021.

There had been a "renovation boom" as homeowners stayed put due to finance restrictions or a lack of choice.

Next year, pressure on lending rates would continue and further lending regulation could hit investors hard who could start to cash in and list properties, the report said.

"Sales volumes have already turned a corner and are likely to be much quieter in 2022, with the pace of annual value growth surely set to continue to ease from a figure of more than 25% for calendar 2021 to perhaps low single digits in 2022."