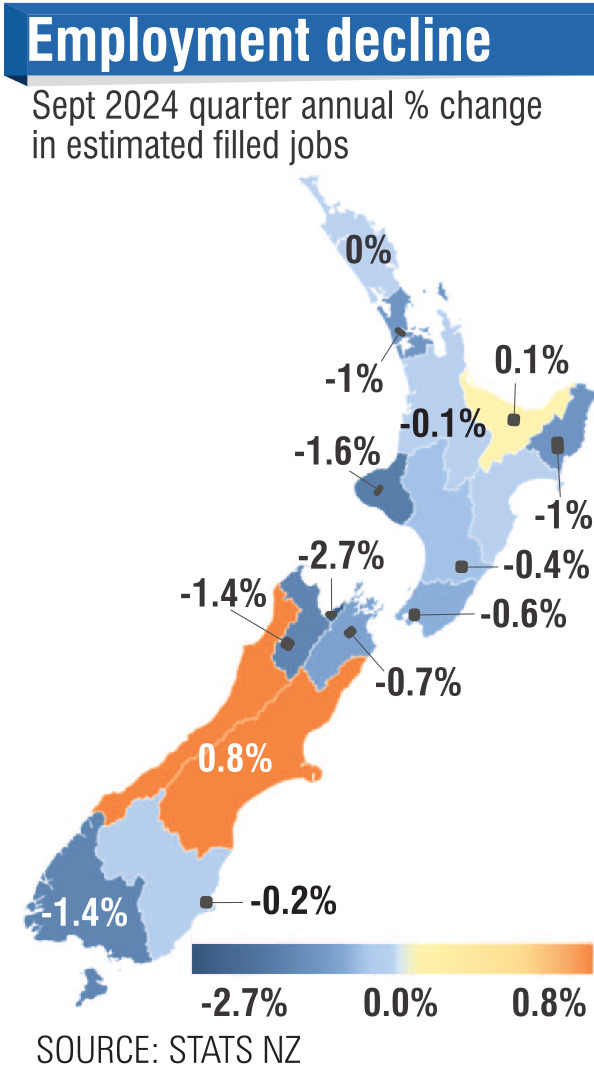

Economic consultancy company Infometrics’ "Quarterly Economic Monitor", released today, showed regional economies were still under pressure.

"Provincial and rural areas are feeling the pinch the hardest, with a 0.3% and 0.4% annual fall in economic activity recorded respectively over the September 2024 year.

Metro areas experienced a small, 0.1% pa, increase in activity," the report said.

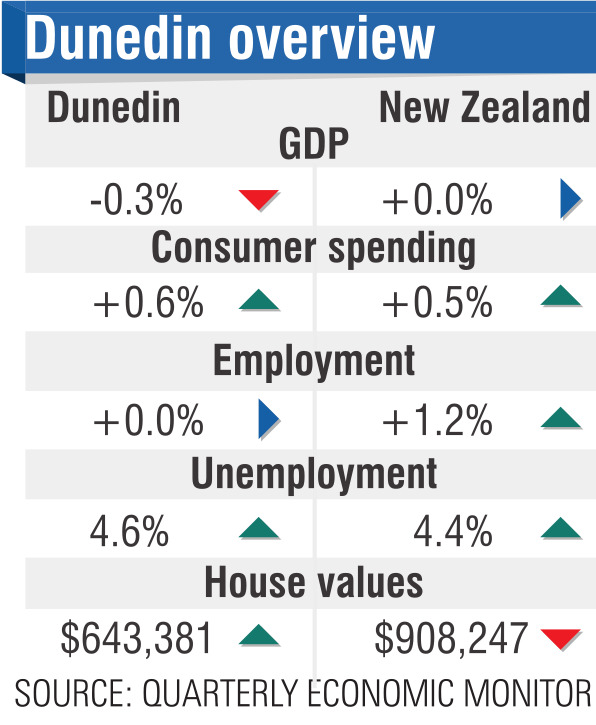

Infometrics principal economist Nick Brunsdon said Dunedin’s economy appeared to have followed national trends and plateaued.

"Dunedin’s economic activity in the September quarter was exactly the same as last September," he said.

"On an annual basis, it’s down 0.2%, but what we’re seeing is that Dunedin appears to be kind of bottoming out in this current cycle ... it’s not declining any further."

Employment in Dunedin had been strong but was beginning to "tail off" in construction, professional services and in the public sector.

In general, the city had a diverse economy with high value sectors such as professional and technology services, and large employers, like the hospital and tertiary providers, Mr Brunsdon said.

Infometrics chief executive Brad Olsen said the national economy appeared to be reaching a turning point.

While construction and retail spending were low and households remained cautious, prices in the primary sector were recovering.

"So greener shoots for things to come. Still [a] challenging environment at the moment — but maybe a little bit of a shift in momentum.

"At the moment [economic indicators are] still bad, they’re still challenging, businesses and households are still under a lot of pressure."

Fears about job losses were likely to continue to dominate until the impact of lower interest rates was felt, which might be up to nine months.

Households would lead the economic recovery, he said.

"Until both households and businesses start to see better levels of activity, until households are feeling confident enough to start spending a bit more, it will take probably again that six- to nine-month period before all of that comes through enough to really start to spark up the economy.

"This analysis highlights that there are some very early signs of a turning point but we’re not seeing an immediate spark up in the economy quite as quickly as I think people might hope for."