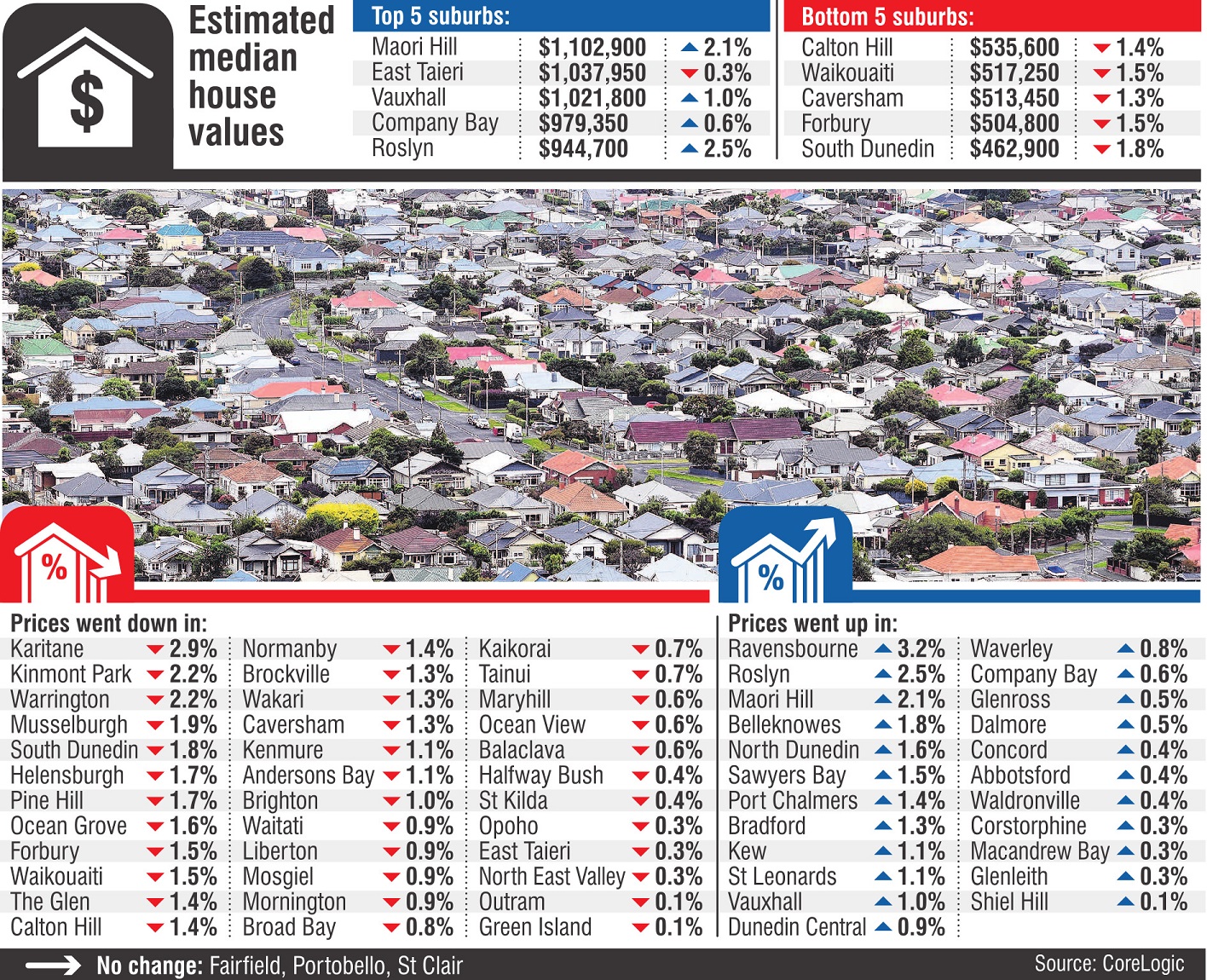

The numbers were revealed in a CoreLogic analysis of median house prices in the three months to February of this year.

There were 36 Dunedin suburbs that had a decline in median house price in this time and 19 of these dropped by more than 1%.

Karitane’s 2.9% decline had it crowned the Dunedin suburb with the biggest drop, while Kinmont Park and Warrington shared the second step of the podium with falls of 2.2%.

The remaining 26 suburbs all had increased median prices, 11 of these having a rise of 1% or greater.

Ravensbourne was the biggest grower, up 3.2%, while Roslyn and Maori Hill saw rises of 2.5% and 2.2% respectively.

Maori Hill was the most expensive suburb in Dunedin with a median house price of $1,102,900, while at the other end of the scale South Dunedin was the only suburb with a median price below $500,000, at $462,900.

CoreLogic chief property economist Kelvin Davidson said Dunedin was one of several markets, including Auckland and Wellington that experienced bigger price booms in recent years.

This meant they were a little more vulnerable to falls in prices.

However he did not think the drops were necessarily indicative of larger decreases around the corner.

"Generally speaking, we’re not anticipating a major correction, more a soft landing. But the unemployment rate holds the key, so any upwards trend for that indicator could mean bigger falls in house prices."

Infometrics chief forecaster Gareth Kiernan said changes to the Credit Contracts and Consumer Finance Act (CCCFA) alongside increasing mortgage interest rates were two elements that might be putting downward pressure on the market.

He said he had been sanguine about the housing market in the latter part of 2021 as low unemployment rates meant people would generally be able to continue to service their mortgages even if they could not sell their house.

However, given the large rises over the past two years there may yet be scope for another few percentage points to be shaved off prices "in terms of some of that froth really just being knocked off the top of the market".

Cutlers sales manager Donald Muldrew said he had noticed a slowing in the market for houses in the $500,000 to $800,000 price bracket.

One house that his company sold recently was asking for offers over $585,000 and ending up selling to the only offer it received at $570,000.

"Six months ago that was a $630,000 house, with pressure on it to even go higher."

Harcourts Dunedin manager Richard Stringer said sales at the top of the market and with people looking to move to their second home were still strong, but lending restrictions had affected the entry level into the market.

Meanwhile, Queenstown-Lakes district prices proved more resistant to decline, with only three suburbs recording falls and Lake Hayes the only one with a drop of over 1%, recording a drop of 1.9%.

Despite this drop Lake Hayes remained the country’s most expensive suburb outside Auckland with a median price of $2,291,450.

Posting gains were Lower Shotover and Luggate at 5.3% growth, Arthurs Point which was up 5% and Lake Hawea up 4.3%.

Elsewhere around the region, growth was the order of business with every part of the Clutha, Gore and Waitaki districts showing increases.

Invercargill had growth in 21 of 23 suburbs, Central Otago in seven of eight regions, and Southland in six of nine.

Comments

It may be regarded as soft, but they haven't landed yet.. ;)

The market has no doubt come off the fire, 2 story home 1 block from me in popular flat over the hill suburb had been listed at offers above 835k before xmas. After little interest this was revised in February and relisted at offers above 679k and sadly still no interest.

Most houses outside of Auckland, are generally still around $100k over priced..