Traditionally, if there are more properties available to rent, it gives renters leverage on price because they have more choice and property owners bring rental prices down to attract renters.

But when the number of rental properties does not keep pace with demand, the property owners can charge more because renters have less choice.

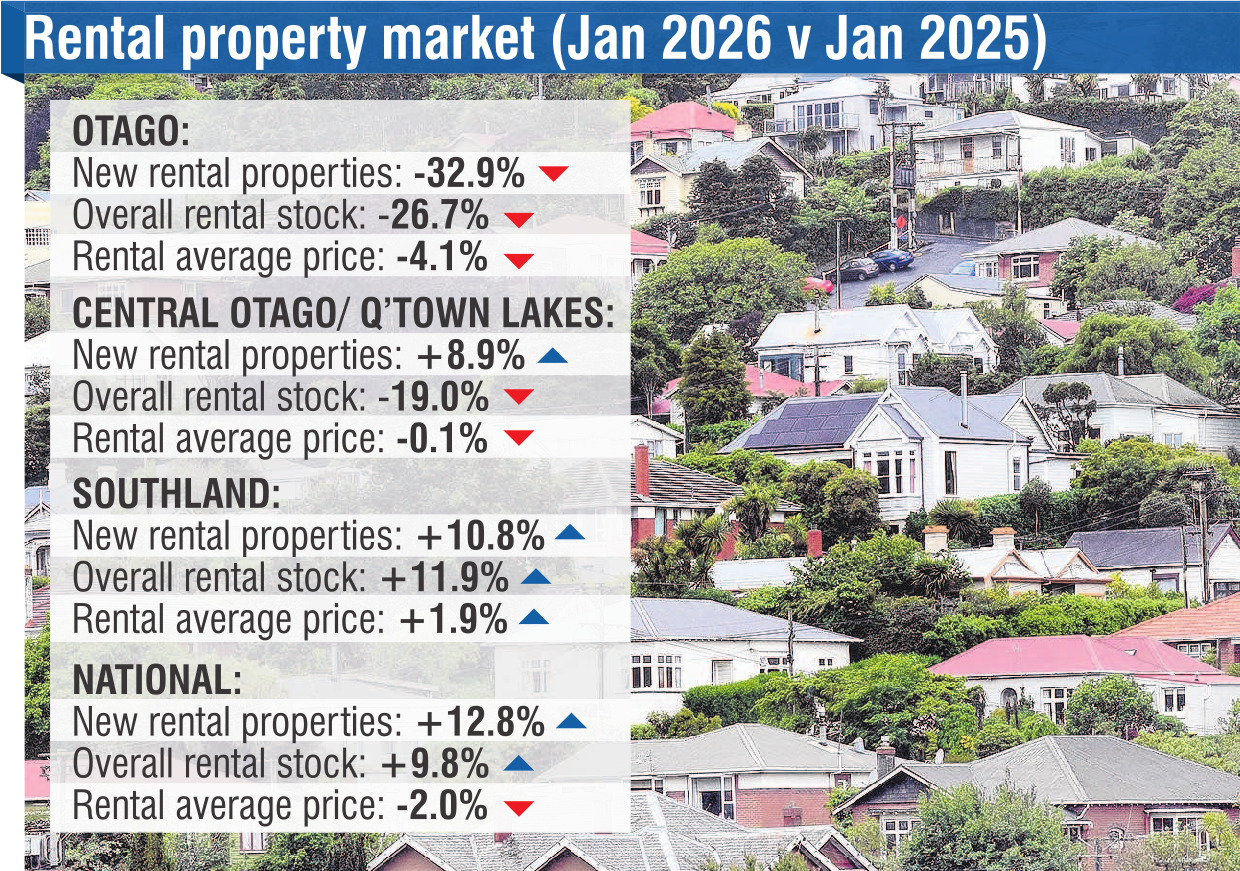

The latest national rental property survey (January 2025 to January 2026), conducted by realestate.co.nz, showed the Otago and Southland rental markets did not follow those economic principles.

Only 139 new rental properties were listed in Otago in January this year — down 32.9% on the 207 in January 2025 — and the overall stock of rental properties in Otago had also dropped by 26.7% compared with January 2025.

Despite supply dropping by more than a quarter, the average rental price also dropped by 4.1% (from $541 per week in January 2025, to $519 in January 2026).

In Central Otago and Queenstown Lakes, new listings had increased by 8.9%, but the overall stock of rental properties had dropped by 19% and the average rental price fell 0.1% over the past year (from $827 to $826).

However, it was a different picture in Southland. The number of new rental properties rose in January 2026, up by 10.8% over January 2025; the stock of rental properties increased by 11.9%; and the average rental price also lifted, by 1.9% (from $475 to $484).

Despite the anomalies in the principles of supply and demand in the southern regions, the nationwide rental market reacted as expected under the principles.

Nationally, new listings increased by 12.8%, rental stock increased 9.8% (from 7129 to 7830) and, as a result, the increased choice in rental properties drove the average rental price down 2%, from $646 per week in January 2025 to $634 in January 2026.

Realestate.co.nz spokeswoman Vanessa Williams said the anomalies, particularly in Otago, were the result of the market being slow to respond to the amount of rental properties on the market.

"When I looked at the number of homes in Otago, I saw listings were down and also prices were down — that doesn't make any sense.

"What you've got to look at with the property market is that when you see a shift in trends — it might be new listings up or down — you've got to see that trend for a while before it will then flow into either asking prices increasing or decreasing."

She said rental markets across the country were behaving "very differently".

"Overall, this is a rental market offering very different experiences, depending on where renters are relocating.

"For those who have flexibility around location, there are real opportunities emerging, but in tighter markets, preparation and speed remain key.

"Understanding local conditions has never been more important."