By Kate Newton

Homeowners are under-insuring their houses, ratcheting up their excesses and using savings to help cover "shocking" increases to their insurance premiums.

Others have told RNZ that it has become increasingly difficult to get full insurance on their property.

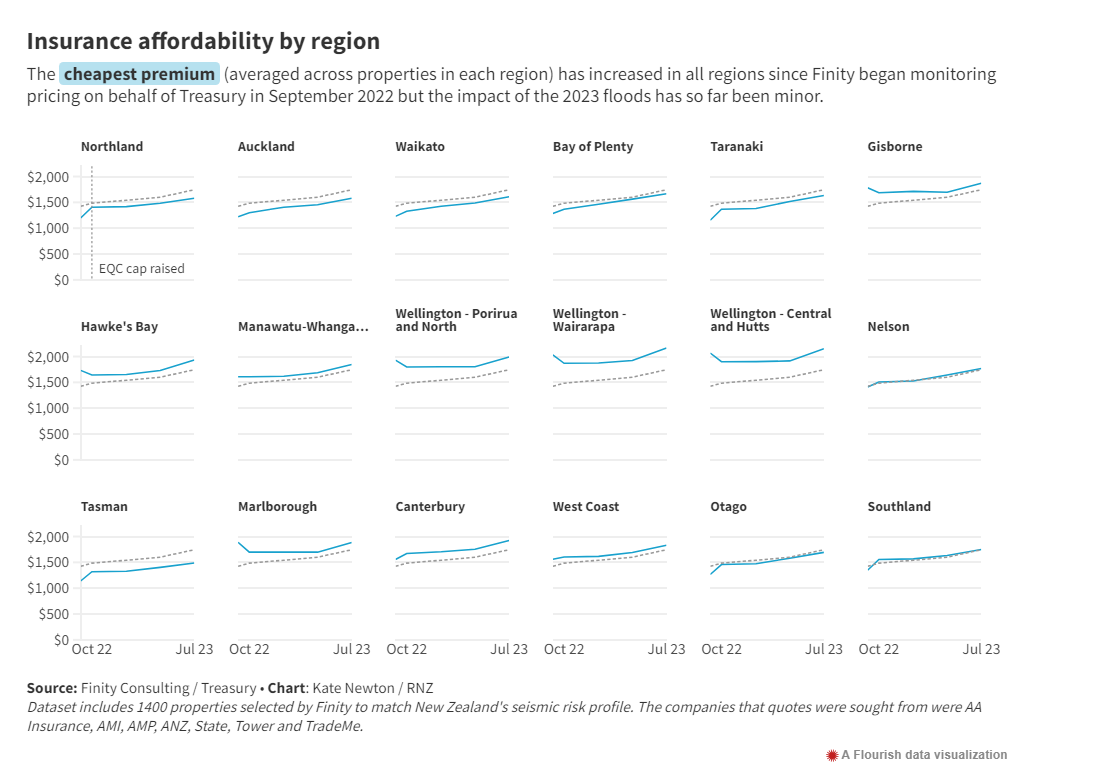

RNZ reported last week on price monitoring data provided to Treasury, which showed average premium increases of 23 percent between September 2022 and July 2023, and more than 30 percent in some regions.

The data also revealed that some major underwriters do not provide automatic cover online for properties in high risk earthquake and flood areas, particularly in Wellington and Marlborough.

A climate change researcher specialising in disaster economics has warned both trends are merely a taste of what could come as the risk of climate change-driven natural hazards increases.

Treasury has refused to provide its most recent data from January this year.

Year-on-year double digit increases

However, dozens of people from around New Zealand have shared their experiences with RNZ, saying they were blindsided by increases that sometimes totalled thousands of dollars.

They reported single-year increases of up to 60 percent, which in some cases came on the back of large jumps the previous year.

In many cases, people chose to lower the sum their house was insured for, which helped to bring down their premium but would leave them more exposed if their home was severely damaged or destroyed.

Julie Harris and her partner were "shocked" when their annual renewal letter arrived last month informing them the premium on their home at Waikanae Beach on the Kāpiti Coast was rising from $4000 to $6300 a year - an increase of 58 percent.

"I looked at it and I tried to figure out how the numbers could be so big," Harris said.

The natural disaster component of their premium rose by $1100 - nearly half the overall increase.

Climate change and disaster economics researcher Ilan Noy has previously told RNZ that premiums would continue to go up as climate change increased the risk of natural hazards such as flooding and landslips.

The original Land Information Memorandum (LIM) Harris and her partner got from their local council when they built the house 14 years ago showed some ponding areas on the property, but there had never been any serious flooding and the council had not notified them of any change to the LIM.

"We've had no indication from our insurers or the council that we're at greater risk now, sitting where we are, than we were a year ago, 10 years ago."

There had been broader assessments of the Kāpiti Coast in that time about the risk of sea level rise and coastal erosion, she said. "But that's a generalisation across the coast, so we don't know specifically how that would impact us sitting in our house."

The couple ended up increasing their excess by five-fold, from $500 to $2500.

That reduced the new premium slightly, but they were still paying an extra $150 a month, which was coming out of their savings, Harris said.

They were in their early 60s and still working, but further big increases could threaten their plan to stay in the house well into retirement.

"If we had increases like this in the next few years we'd have to reconsider living here - not because we think we're in danger of anything, just because maybe a smaller place in a different area would have less insurance cost, perhaps."

A 'really unpleasant shock'

Charlie, a solo parent who owns a house in Lower Hutt, had budgeted for a 20 percent increase after getting stung with a similar premium rise the year before.

"Nothing could have prepared for the fact that [this year] it was actually a 35 percent increase," she said.

"It was a really unpleasant shock."

Like Harris, her house was not in a marked hazard zone and she could not get a clear explanation for the increase.

After talking to her insurer, she reduced the value her home was insured for and doubled her excess.

"That brought it down to a level which was in keeping with what I'd saved [for insurance] the year previously."

Insuring the house for less was "never a good feeling", Charlie said.

"I had to make an educated bet that chances were I wouldn't have to make a claim and, if I did, then I'd just have to suck it up."

Even with a lower increase she has still had to reshuffle her household finances.

"I have a very, very tight budget - on a single income I have to be very careful," she said. "I don't buy lunch, I don't buy coffees - those discretionary items were the first to go."

More than 20 other people who contacted RNZ shared similar stories to Charlie and Julie.

One Wellington homeowner facing a 50 percent increase was among those taking their chances with a lower level of cover.

"We ended up increasing our excesses and reducing our coverage slightly to end up with approximately a 35 percent increase but we're now really pushing the limits of how low we're comfortable with our coverage being."

They were among Wellington homeowners struggling to get automatic insurance, saying they had not been able to get quotes online "for a few years now".

Another Wellington owner of a three-bedroom house said her insurance increased from $2545 in 2022 to $3280 in 2023, and then $4480 this year - a 76 percent increase over two years.

"To say I choke when the bill comes in each year is an understatement. I'm a single mum and spend the whole year putting aside money to pay for it."

Tim Grafton, who was chief executive of the Insurance Council until last week. Photo: Supplied

Napier homeowners reported some of the most eye-watering increases, in the wake of flooding from Cyclone Gabrielle last year - even if their properties were not affected.

One lifestyle block owner whose house was unscathed but made an insurance claim for damage to a lower paddock and barn said her premium had nearly tripled since 2022, from $2300 to $6300.

People from Oamaru, Northland, Whanganui, Auckland, Nelson and Christchurch were among others to report increases ranging from 20 percent to 59 percent in a single year.

Tim Grafton was chief executive of the Insurance Council until last week. Photo: Supplied

Tim Grafton was chief executive of the Insurance Council until last week. Photo: Supplied

Stop building 'in dumb places'

Former Insurance Council chief executive Tim Grafton told RNZ before his tenure ended last week that recent jumps in premiums were "unusual". The increases were driven by big increases in the cost of construction - which affected rebuild costs - and soaring reinsurance after multiple severe weather events in New Zealand and globally.

Climate change was increasing the risk of some natural hazards and with no changes to the status quo, insurance could become increasingly unaffordable, he said.

"What we want to do is steer away from that kind of outcome, so we need to have good regulations and legislation in place that prevent us from building in dumb places [and] prioritising how we make those places that are already built more resilient in the future."