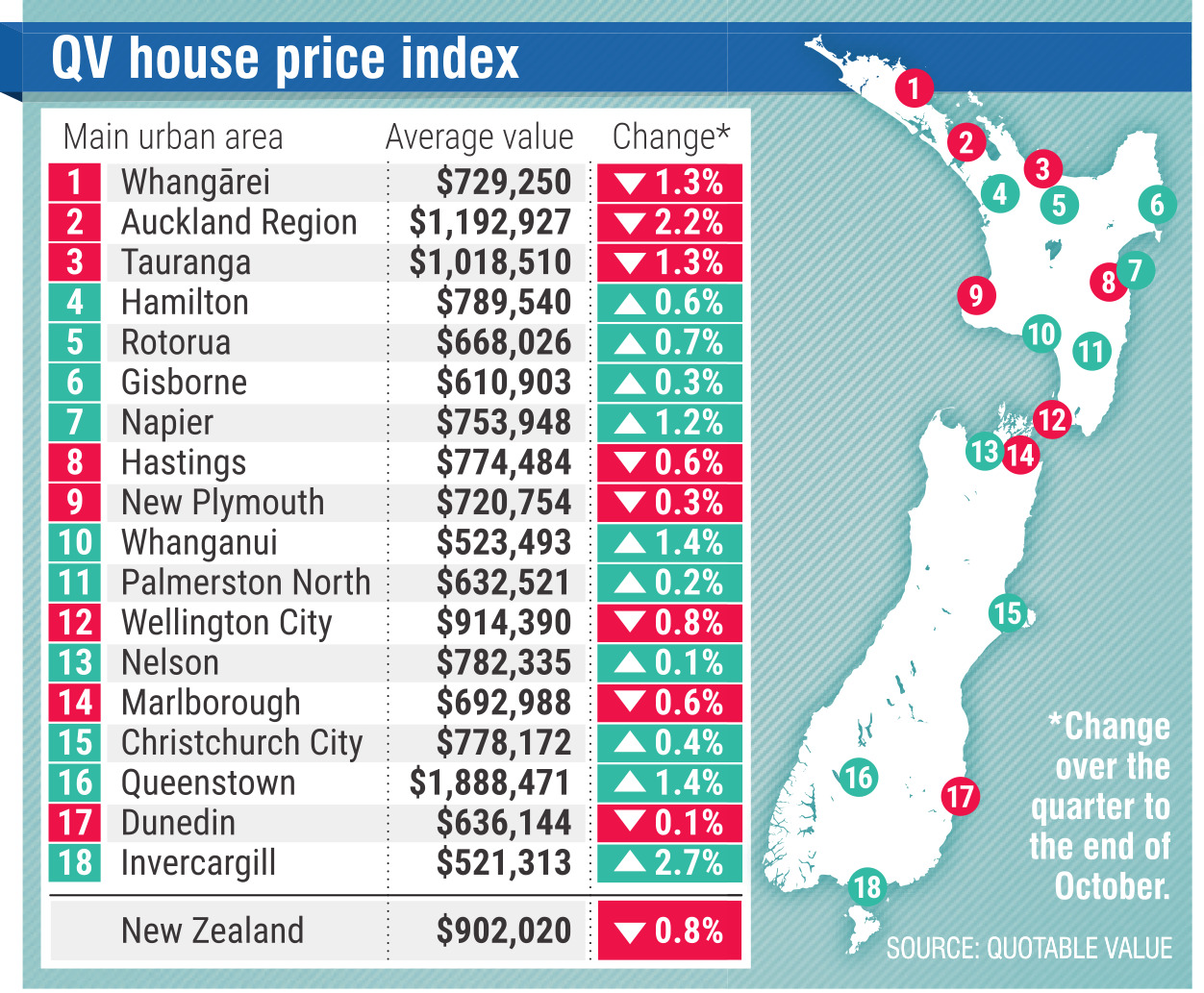

QV’s latest house price index shows average home values across New Zealand fell 0.8% over the quarter to the end of October, with the national average now sitting at $902,020. That figure is unchanged from the same time last year and remains 13.9% below the nationwide market peak of January 2022.

Across the main centres, Auckland recorded the steepest fall, with average values down 2.2%, followed by Whangārei and Tauranga, both dropping 1.3%. Wellington City’s recent declines have steadied to a modest 0.8% fall, while Hastings fell 0.6%, New Plymouth dipped 0.3% and Dunedin edged back just 0.1%.

The strongest regional gains were seen in Invercargill, up 2.7%, followed by Queenstown (1.4%), Napier (1.2%) and Central Otago (1.1%).

QV said Southland continued to outperform much of the country, buoyed by the strength of the primary sector and the region’s relatively low entry point to the housing market. Values there rose 2.2% over the quarter to an average of $516,682 — up 6.4% year-on-year.

Invercargill’s average home value increased 2.5% to $521,313, now 8.2% higher than a year ago and 8.4% above the national market peak of early 2022.

Gore District, meanwhile, saw a 1.3% quarterly dip to $436,403, though values remain up 7.7% annually. Southland District values rose 2.5% this quarter to $547,013, 1.9% higher than a year ago.

QV Invercargill registered valuer Andrew Ronald said investor interest continued to lift, especially from out-of-town buyers drawn by strong rental returns.

"Well-priced properties are tending to sell quickly and listings remain tight, which is helping to support rising home values in Invercargill and Gore," he said.

"Demand for properties above $1 million remains limited, with buyer caution still evident at the top end of the market."

In the Queenstown Lakes District, residential property values rose 1.8% over the past year and 1.4% in the three months to October, with the average home now valued at $1,888,571. Neighbouring Central Otago District recorded stronger annual growth of 5.5%, with a modest 1.1% quarterly lift to $870,225.

QV Queenstown registered valuer Greg Simpson said the residential market in both districts had remained active and resilient despite broader economic challenges.

"The market has performed steadily over the past year, but there’s a high potential for change as broader economic uncertainty continues to influence buyer and seller behaviour," Mr Simpson said.

"We’re seeing increasing inventory levels, growing monthly sales volumes, and generally steady value levels as reflected in the average house price."

Mr Simpson said tight credit conditions continued to temper activity at the upper end of the market.

"Building cost inflation is easing, but construction periods remain extended. On the other hand, vacancy rates for commercial accommodation providers have improved, and residential rental levels appear to be flattening at existing levels. Overall, most parts of the district are now operating at normal activity levels."

Queenstown Lakes continued to command higher selling prices than most other parts of the country, a trend unlikely to change soon.

"The ongoing recovery of the tourism industry and the continued shortage of housing in key centres such as Queenstown and Wānaka are expected to support values going forward," Mr Simpson said.

In Dunedin, average home values dipped just 0.1% in the three months to October to $636,144 — unchanged from a year ago and 11% below the nationwide peak of early 2022.

QV Dunedin valuer Baylan Connelly said limited listings for "A-grade" homes continued to restrict supply.

"There is strong demand in the first-home buyers’ market, particularly for properties in the $450,000-$600,000 range.

"A preference for modern, new builds in St Clair and Māori Hill is evident, with new supply entering the market to meet this demand.

Interest rates were easing, creating a positive outlook heading into summer.

On the West Coast, property values also lifted, led by Westland up 3.4% and Buller up 2.8%, with Grey District rising 0.4%. Average home values across the wider region increased 1.9% in the quarter to $450,098.

In Waitaki, values dipped 0.9% over the quarter and 0.7% annually to an average of $507,384, reflecting a stable market still sitting 4.3% above the 2022 national peak.

In Timaru, values fell 0.7% in the October quarter and 1.5% over the year to $527,973, which remains 7.6% higher than at the start of 2022. — Allied Media