Cr Lee Vandervis, who is running for the mayoralty, took issue with recent commentary by Dunedin Mayor Jules Radich.

The mayor, who is seeking re-election, pointed out the Dunedin City Council had stopped running up deficits and he observed rising debt was set to flatten out in five years.

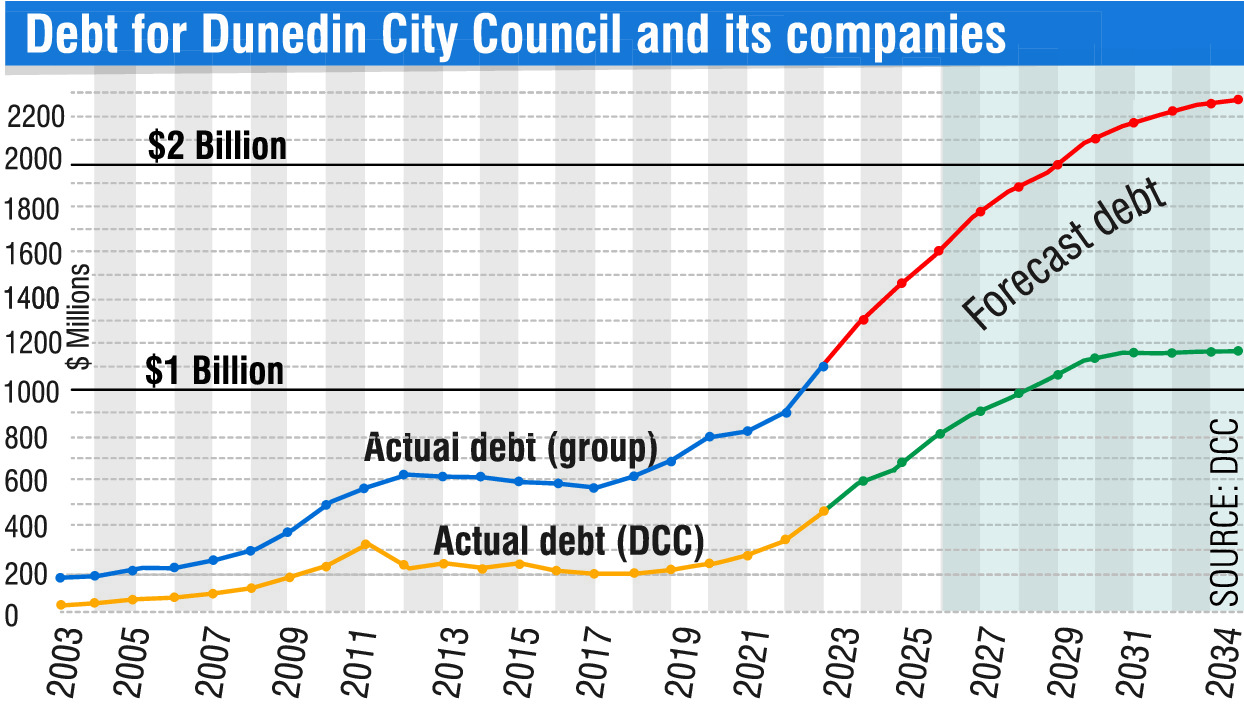

Mr Radich also highlighted a council graph that drew a distinction between water services and other council debt, and which also presented debt for Dunedin City Holdings Ltd (DCHL) and subsidiaries, the collection of council companies.

As the mayor described it, "core" council debt "starts to drop after five years, core debt + water flattens and core + water + DCHL still rises to fund company growth".

"Debt is under control," he said in an advertisement at the weekend.

Cr Vandervis referred to the increase in council debt in the past year and the projected increase in 2025-26.

Council debt and company debt — together known as group debt — were each forecast to exceed $1b before the 2025-34 long-term plan (LTP) was through, "each costing us $1m per week just in interest payments and there is no payback plan for DCC, company or stadium debt", Cr Vandervis said.

He preferred a graph that showed historical debt levels back to 2003, as well as projected debt.

The mayor’s suggestion "core" council debt would drop after five years was presented in council material as DCC debt excluding water, and this metric shows projected decreases from 2030.

Cr Vandervis described this as a "future fantasy".

Mr Radich described Cr Vandervis as "sceptical" after many years at the council.

"Anyone can see that core council debt excluding water starts dropping after five years and total council debt flattens, hence my contention that debt growth is under control when the LTP is looked at as a whole."

Mr Radich had quite a different reading of the situation in February, when he urged councillors to avoid adding to the rising council debt that had already been included in draft budgets.

"We have been on a skyrocket trajectory of ever-increasing debt levels," he said at the time.

"That is not sustainable and we don’t have to stay there."

In March, S&P Global Ratings downgraded the council’s credit rating.

Debt for water infrastructure is set to increase steadily each year through to 2034.

Cr Vandervis said his debt solutions included "back-to-basics spending", getting commercial returns out of council-owned companies, selling off land that was "unused" or provided low returns and reversing planned zero-carbon spending.

He also said the council should pause the $92.4m Smooth Hill development "and other non-urgent projects".