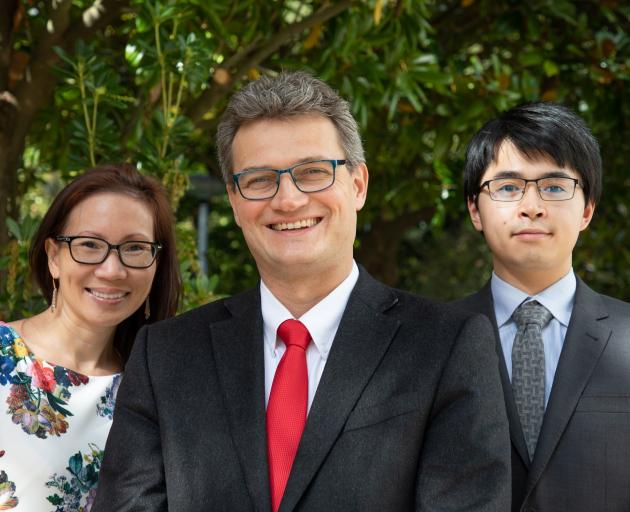

The new research, co-authored by Department of Economics and Finance head Professor Jedrzej Bialkowski, Dr Huong Dang and Dr Xiaopeng Wei, has been accepted for publication in the Journal of Financial Economics.

Bialkowski says they explored how the strength of political signals impact the relationship between market volatility and economic policy uncertainty.

"We observed a puzzling phenomenon following the election of Donald J. Trump in the United States and the Brexit referendum in the United Kingdom," Bialkowski said.

"Certain well-established financial relationships did not hold anymore.

"Traditionally economic policy uncertainty and a benchmark of fear of the market, known as the Volatility Index (VIX), have a very strong positive relationship, but we saw these move apart.

"We find evidence for existing theory that claims that the relationship might be affected by the quality of political signals.

"Political signals show strength in the information of what politicians say and in their actions. So certainty around: If they say A at the start of the week, they won’t say B at the end of the week.”

The research has resulted in developing a measure - called the Qindex - for the quality of political signals.

"In our paper we show if the quality of political signal is low it breaks some of the well-established relationships in a financial market. In order to achieve it, we have come up with a benchmark for the UK and US which tells us what the quality of the political signal is at a given moment."

The research team has developed indices for the United States and United Kingdom, with future indices being developed for Canada, Australia and New Zealand.

The benchmarks could be compared to a measure that journalists came up with – The Washington Post fact-checker.

"Our measurement is more scientific and can provide further insight into the uncertainty of financial markets at any given moment.”

The research team is publishing the Qindices on a monthly basis here.

The paper - High policy uncertainty and low implied market volatility – an academic puzzle? - will be published in the Journal of Financial Economics